Processing Redundancy pay

Article ID

11624

Article Name

Processing Redundancy pay

Created Date

4th February 2020

Product

IRIS Payroll Professional, Earnie

Problem

How to process redundancy pay.

For redundancy pay legislation information check www.gov.uk here.

Resolution

Redundancy payments under £30,000 are normally tax and NI free. From the 2020/21 tax year any amounts above this figure will subject to tax and employers class 1A NI contribution.

Changes from 2020/21 Tax Year

Once you move into the 2020/21 tax year you will need to calculate tax and employers class 1A NI contribution on redundancy pay over £30,000

In order to do this you will need to create a new payment code

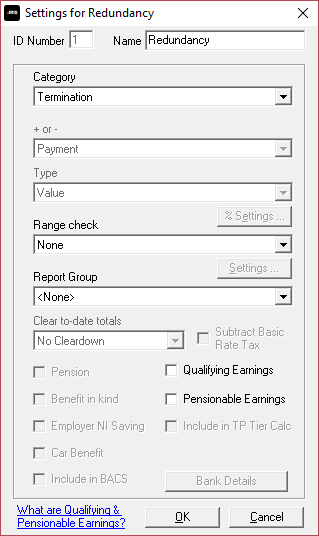

- Go to “Company” > “Alter Payments / Deductions“

- Click “Add new“

- Click “No” to the wizard message.

- You will need to type in a name for the payment. This is how the item is shown on the payslip.

- Set the Category to “Termination“

- Click “OK” to save the payment:

When you use this payment code you no longer need to split redundancy payment over/under £30,000 as was the previous method.

This new payment type will automatically be tax/NI free for values under £30,000. If you use the code with a value over £30,000 tax will be deducted and employers class 1 NIC will be calculated correctly.

Please Note: There is still no employees NI contribution on redundancy payments over £30,000.

Previous advice, prior to 2020/21 tax year

For redundancy payments, the first £30,000 are tax & NI free. Any amount over this would be subject to tax, in order to achive this you will need to set up two payment codes.

To set up the First £30,000

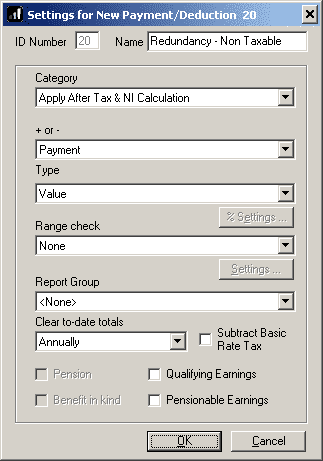

- Go to “Company” > “Alter Payments / Deductions“

- Click “Add new“

- Click “No” to the wizard message.

- You will need to type in a name for the payment. This is how the item is shown on the payslip.

- Set the Category to “Apply After Tax & NI Calculation“

- Set + or – to “Payment“

- Set Type to “Value“

- Set range check to “None“

- Set report group to “None“

- Set clear to-date totals to “Annually“

- Click “OK” to save the payment:

You can now use this paycode to pay a tax and NI free amount to employees

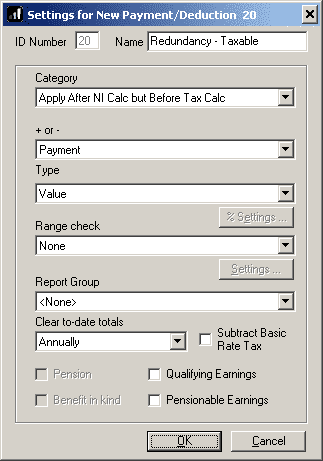

To set up amount over £30,000

- Set up another new payment exactly as above EXCEPT:

- et the Category to “Apply after NI Calc but Before Tax Calc“

- Use this code to pay employees a value that will be taxed but will not affect the NI calculation.

- Enter the remaining value of any redundancy over the £30,000 level.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.