Can I include a Net bonus with an employees normal pay?

Article ID

11801

Article Name

Can I include a Net bonus with an employees normal pay?

Created Date

21st November 2019

Product

IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

Can I include a net bonus with an employees regular gross pay?

Resolution

In order to process on a net to gross basis you first need to set up a net to gross pay code at the company level.

Set up payment type:

Go to “Company” | “Alter Payments/Deductions”. Click “Add New”.

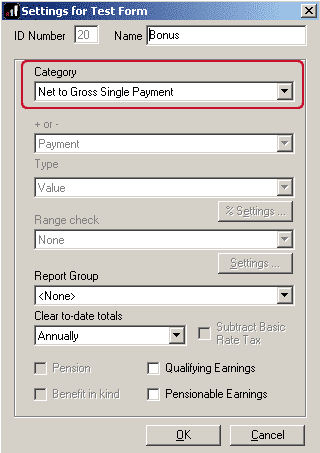

Give your new payment a name and select “Net to Gross Single Payment” as the category. click “OK”.

Using the payment.

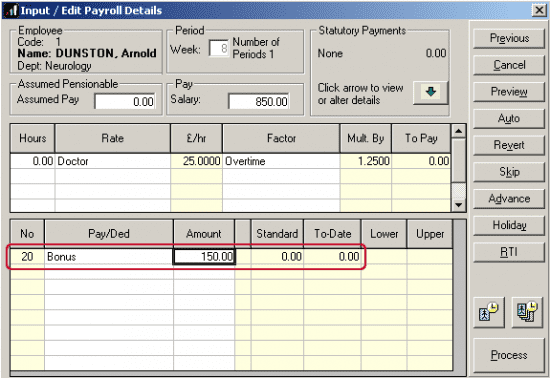

Go to “Payroll” | “Do/Redo Payroll”. Click into the payment / deductions list in the bottom part of the window. From the menu select the new payment you have just set up:

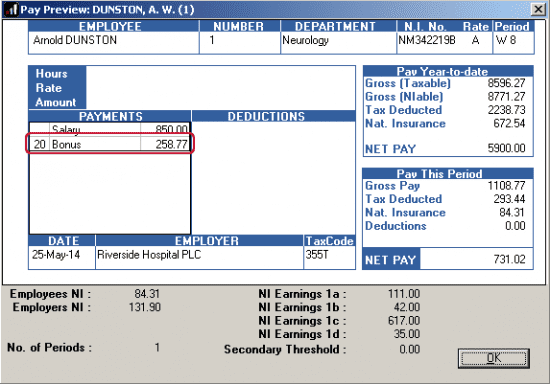

Enter the extra net amount you want the employee to take home. When you process the payroll the system will calculate how much gross pay is required to give the employee the additional desired amount:

PLEASE NOTE: IPP/Earnie is unable to calculate a NET to GROSS payment if:

The employee circumstances would generate a tax refund.

The employee has an attachment of earnings set up.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.