What is the Pay reference period?

Article ID

11881

Article Name

What is the Pay reference period?

Created Date

1st May 2019

Product

IRIS Payroll Professional, Earnie, IRIS Bureau Payroll, IRIS Payroll Business

Problem

What is the pay reference period?

How does this affect enrolment/postponement dates?

What from and to dates should I use when creating my AE pension export file?

Resolution

Whenever you are exporting your pension data you should always use the from and to dates to match the “Pay Reference Period“.

Alternatively, you can select a tax week or month number when exporting your pension data. This will automatically use the start and end dates as set in the payroll calendar.

What is the Pay Reference Period (PRP)?

This is probably the most queried aspect of auto enrolment our support team receive. Understanding the PRP is key to understanding the way the software assigns enrolment/postponement dates etc.

The PRP is the period of time an employee’s auto enrolment assessment is based on.

This has been tested thoroughly in our software and shown to comply with The Pension Regulators guidelines. The confusion that arises and results in calls to support are usually down to:

• When a payroll runs in arrears it gives the impression the employee is enrolled a period too early.

• The payroll calendar information hasn’t been configured correctly.

• The corresponding information hasn’t been configured correctly with the pension provider.

How is the PRP determined?

The PRP is defined by the date an employee is paid NOT the period worked. This is important as it can cause confusion for employees who are being paid in arrears.

To determine an employee’s PRP, the payroll:

• Identifies the Payroll Date for the pay period being paid

• Checks the Payroll Calendar to determine the Start and End dates that contain that Payroll Date

Examples:

1. Weekly Payroll:

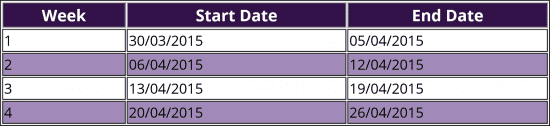

If the company Payroll Calendar is configured like so:

Payroll Week: 1

Pay Date: 10/04/2015

Pay Reference Period: 06/04/2015 to 12/04/2015

Use these dates as from and to dates when exporting pension data for week 1.

Payroll Week: 2

Pay Date: 17/04/2015

Pay Reference Period: 13/04/2015 to 19/04/2015

Use these dates as from and to dates when exporting pension data for week 2.

Payroll Week: 3

Pay Date: 24/04/2015

Pay Reference Period: 20/04/2015 to 26/04/2015

Use these dates as from and to dates when exporting pension data for week 3.

2. Weekly Payroll:

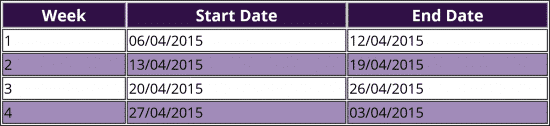

If the company Payroll Calendar is configured like so:

Payroll Week: 1

Pay Date: 06/04/2015

Pay Reference Period: 06/04/2015 to 12/04/2015

Use these dates as from and to dates when exporting pension data for week 1.

Payroll Week: 2

Pay Date: 13/04/2015

Pay Reference Period: 13/04/2015 to 19/04/2015

Use these dates as from and to dates when exporting pension data for week 2.

Payroll Week: 3

Pay Date: 20/04/2015

Pay Reference Period: 20/04/2015 to 26/04/2015

Use these dates as from and to dates when exporting pension data for week 3.

As you can see in example 1 – when paying a week in arrears it is potentially confusing as the “from” and “to” dates you use are displayed in the payroll calendar as week 2, however, this IS correct as per TPR guidelines. As long as all of this information is correct and configured as such in BOTH payroll and with the pension provider there will not be any issues.

Where can I find the payroll calendar?

This depends on which payroll product you are using:

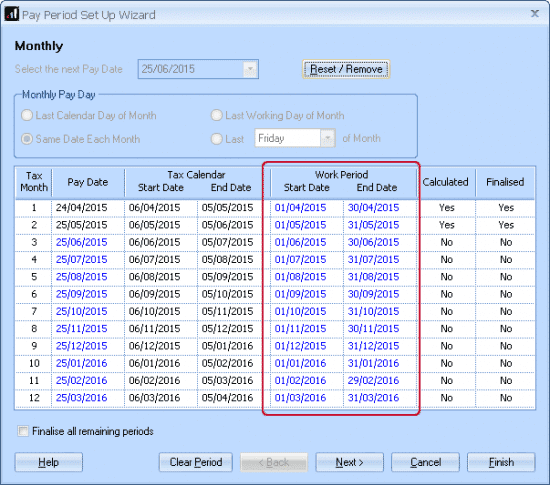

IRIS Payroll Business/Bureau Payroll – Go to “Company” > “Payroll Calendar“. For the purposes of AE assessment, the software is looking in the “Work Period” “Start Date” and “End Date” columns:

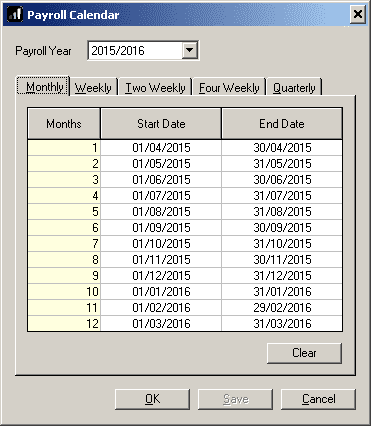

Earnie – Go to “Company” > “Payroll Calendar“:

Please Note: There is no equivalent in PAYE-Master or GP Payroll, these products set the work period to match HMRC tax calendar for which ever pay date is used. i.e month 1 is always 6th April to 5th May. Because of this, when exporting pension information from these products you can select a period number, i.e. month number 1, rather than specify a start and end date.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.