Month(s) missing when printing Annual Partial Exemption Adjustment (VAT) Report

Article ID

11982

Article Name

Month(s) missing when printing Annual Partial Exemption Adjustment (VAT) Report

Created Date

6th April 2018

Product

IRIS GP Accounts

Problem

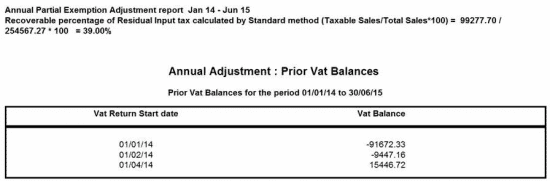

User reports that month(s) are missing when they print the Annual Partial Exemption Adjustment (VAT) Report.

Resolution

If you are a VAT registered practice then you will need to produce a VAT report per period/quarter.

The software has a facility to calculate the VAT return and add an item to the cashbook for the amount of the VAT return. If you have been doing this every month/quarter and you then try to print the Annual Partial Exemption Adjustment Report at the end of the year and find you may have one month missing, but the accounts balance correctly, than the missing month has been entered manually.

Example; As you can see from the example below, the month of March is not showing on the report:

For this example, if you could see an entry for March in the accounts, then this will have been entered manually and not through the VAT return function.

To correct this you will need to unreconcile the manually entry and delete/contra the entry.

Then go to “Reports” > “Cashbook Reports” > “VAT Reports” > “VAT Return Report” and select the missing month.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.