Alternative Director NI option

Article ID

12026

Article Name

Alternative Director NI option

Created Date

6th April 2018

Product

IRIS PAYE-Master

Problem

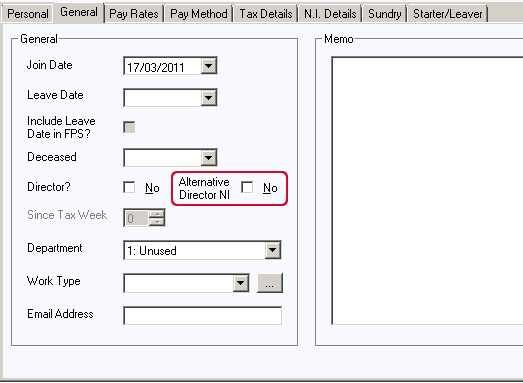

What is the tick box "Alternative Director NI" used for?

Resolution

With the introduction of RTI HMRC has included an indicator which is part of your FPS submissions. The purpose of the indicator is to identify which employees are company directors.

If the “Director?” option is selected this means the director is flagged accordingly on all further FPS submissions. This tick box also activates the directors NI calculation where the annual NI free pay allowance is used up front rather than split across pay periods as it is for normal employees. For more details on the Directors NI calculation, click here. Many directors prefer to have NI calculated the same way as a normal employee with an adjustment applied in the final pay period of the year. Using this method their take home pay is more predictable throughout the year. This is the “Alternative Directors NI” calculation.

So if you have a director on your payroll who wants to have NI deducted under normal rules tick the “Alternative Directors NI” option. PAYE-Master will continue to process the NI in the normal manner but the FPS will correctly indicate this person as a director. Alternatively if the director is happy with the regular directors NI calculation based on annual rules just tick the “Director?” option.

Important note: If you do tick the “Alternative Directors NI” option you must remember to untick the option and tick “Director?” before you process your final pay period of the tax year (or the directors final pay if they leave part way through the tax year). This will ensure a retrospective calculation takes place on the directors earnings automatically making any adjustments necessary to ensure they comply with the directors NI rules.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.