Introduction of an administration levy

Article ID

12116

Article Name

Introduction of an administration levy

Created Date

27th March 2017

Product

IRIS GP Payroll

Problem

Administration Levy NHS England and Wales.

Resolution

What you need to know

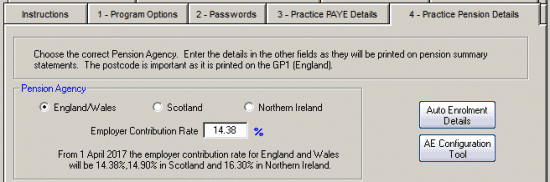

• Only England/Wales practices have the administration levy

• As from 1 April 2017, all practices (England & Wales) will pay an additional 0.08% in employer contributions per member to cover the administration costs.

• This will result in a total Employer’s NHS Pension Contribution Rate of 14.38% (for 17/18 tax year)

• You will not need to enter the value manually – it is uplifted automatically when moving into the new year. NOTE: The software will not let you use the employer’s rate of 14.38% until you have moved into the 17/18 tax year. :

• It is not to be confused with the apprenticeship levy

Full details from the Department of Health can be found here:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.