AE Assessment without a pension fund: GP Payroll

Article ID

12149

Article Name

AE Assessment without a pension fund: GP Payroll

Created Date

6th July 2017

Product

IRIS GP Payroll

Problem

This guide details the process to follow when you haven’t yet set up a pension with a pension provider and you are assessing your employees within the payroll software.

There are two scenarios:

• No employees meet the criteria for auto enrolment

• Some employees meet the criteria for auto enrolment

Resolution

No employees meet the criteria for auto enrolment

At your staging date:

• You don’t have a pension scheme in place with a pension provider

• You will be assessing your employees in the payroll and no employees meet the criteria for you to enrol the automatically

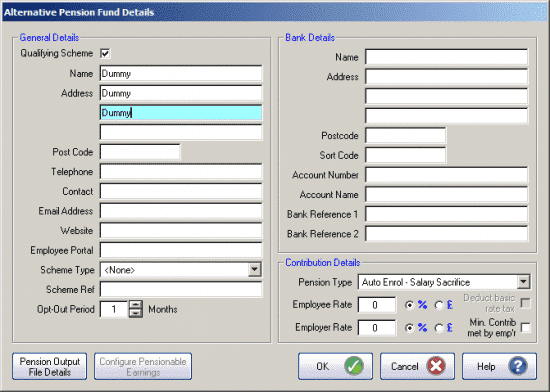

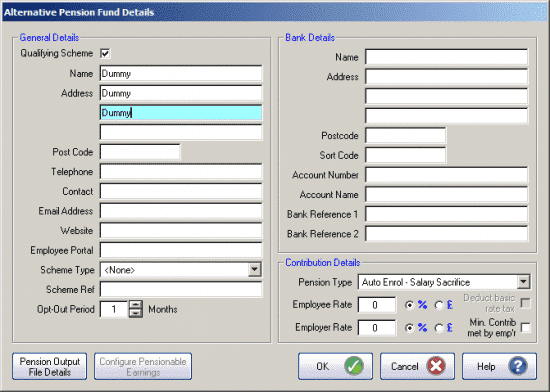

1. For the auto-enrolment assessment to work you will need to have a pension fund available in GP Payroll. While you could use an NHS pension fund we recommend you create a dummy alternative pension scheme for this purpose. Go to Setup/Options | 4-Practice Pension Details | Auto Enrolment Details. Click Pension Fund Details, highlight <The Alternative pension name goes here> and click Edit. As a minimum you will need to complete a name and address lines 1 & 2:

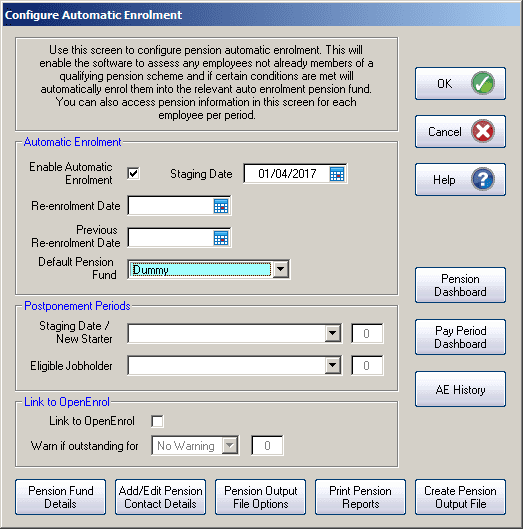

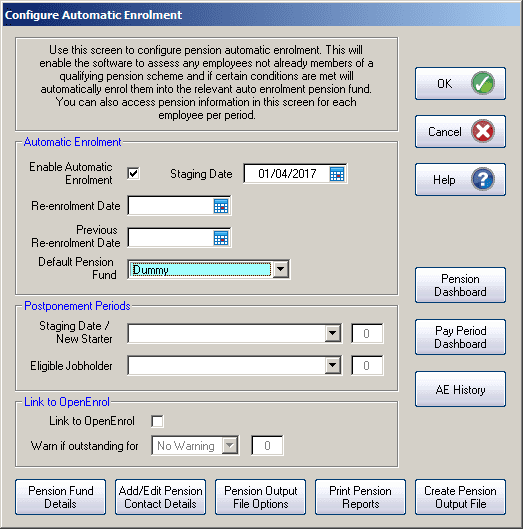

2. Go to Setup/Options | 4-Practice Pension Details | Auto Enrolment Details, enter your company’s Staging date and tick Link to OpenEnrol if you using the service to send the appropriate letters to your employees. Select the dummy pension fund created as the Default Pension Fund.

3. Calculate the payroll as you would normally. If your Staging Date is in the current pay reference period or earlier, the payroll will assess your employees

4. If you don’t have any employees that meet the criteria for you to enrol them automatically, the payroll sets their worker status, applies postponement (if in use) and generates the appropriate letters. The payroll will advise you of the assessment outcome at the end of Payroll Run.

PLEASE NOTE: Even if none of your employees meet the criteria for automatic enrolment, they could still choose to opt-in.

Advice taken from The Pension Regulator:

“If an employer is given an opt-in notice by a jobholder they must arrange active membership of an automatic enrolment scheme. (Opting in is explained in Detailed guidance no. 6 – Opting in, joining and contractual enrolment.) They are required to follow the automatic enrolment process to achieve this.”

Some employees meet the criteria for auto enrolment

At your staging date:

• You don’t have a pension scheme in place with a pension provider

• You will be assessing your employees in the payroll and some employees will meet the automatic enrolment criteria.

1. For the auto-enrolment assessment to work you will need to have a pension fund available in GP Payroll. While you could use an NHS pension fund we recommend you create a dummy alternative pension scheme for this purpose. Go to Setup/Options | 4-Practice Pension Details | Auto Enrolment Details. Click Pension Fund Details, highlight <The Alternative pension name goes here> and click Edit. As a minimum you will need to complete a name and address lines 1 & 2:

2. Go to Setup/Options | 4-Practice Pension Details | Auto Enrolment Details, enter your company’s Staging date and tick Link to OpenEnrol if you using the service to send the appropriate letters to your employees. Select the dummy pension fund created as the Default Pension Fund.

3. Calculate the payroll as you would normally. If your Staging Date is in the current pay reference period or earlier, the payroll will assess your employees

4. If any employees meet the criteria for you to enrol them automatically, the payroll sets their automatic enrolment date and worker status, applies postponement (if in use) and generates the appropriate letters. The payroll will advise you of the employees automatically enrolled at the end of Payroll Run

5. After you have arranged a pension scheme with a pension provider, you need to return to Setup/Options | 4-Practice Pension Details | Auto Enrolment Details | Pension Fund Details and edit the dummy pension fund to reflect the correct details.

6. You should re-run the payroll to assign the pension scheme to any employees eligible for automatic enrolment. The payroll will deduct the appropriate pension contributions from all employees automatically enrolled.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.