Payroll is using last tax years Qualifying Earnings lower limit for AE pension calculations

Article ID

12173

Article Name

Payroll is using last tax years Qualifying Earnings lower limit for AE pension calculations

Created Date

15th April 2020

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

The payroll software is using the AE pension earnings bands from 19/20 for the first period of 20/21.

Resolution

Pension Earnings Bands

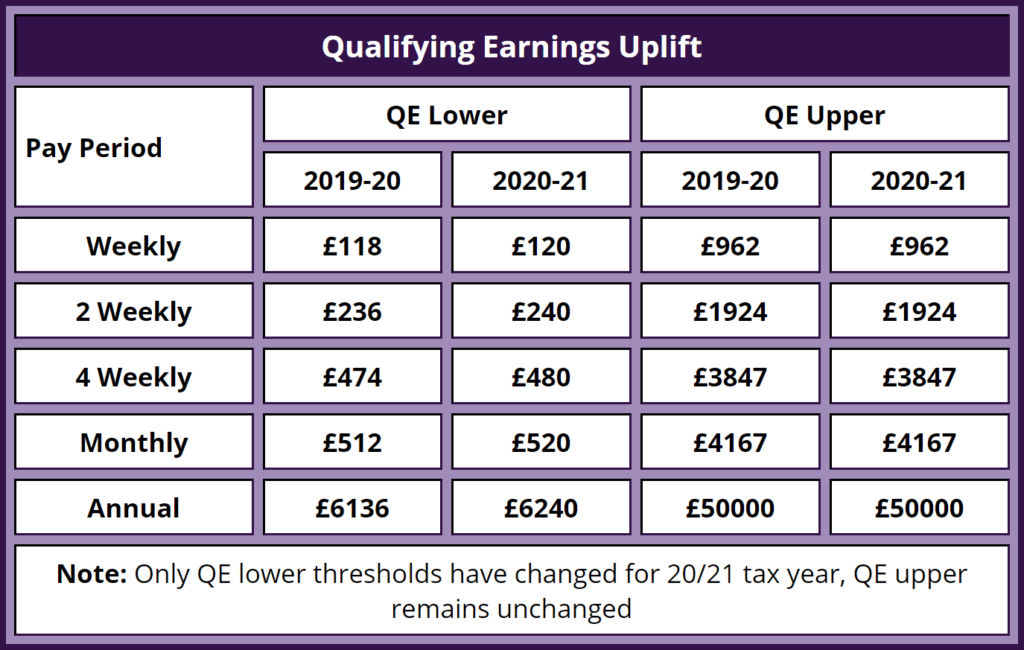

The bands Qualifying Earnings Lower & Qualifying Earnings Upper change when moving into the new tax year.

These changes for 19/20 into 20/21 are:

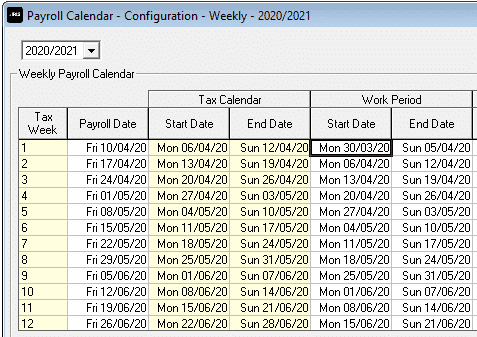

If the PRP start date is in the 2019/20 tax year, the bands that should be used are the 2019/20 bands.

So for the example below, the qualifying earnings lower limit used for week 1 payroll be £118, the 2019/20 rate, as the PRP start date is in the 2019/20 tax year (30/03/20).

If your pension has different requirements ie. Threshold change should be applied to the tax year rather than the Pay Reference Period (PRP).

We have introduced functionality into your payroll software to override this behaviour and apply threshold changes based on tax year rather than PRP. This is a less common scenario so please check with your pension provider if you are unsure.

To alter this option:

IRIS Payroll Business/IRIS Bureau Payroll

Go to “Pension“|”Configure Auto Enrolment“. For the option “AE Thresholds” select either “Use Pay Reference period” or “Use Tax Year“

IRIS Payroll Professional/Earnie/Earnie IQ

Go to “Pension“|”Configure Auto Enrolment“. For the option “AE Thresholds select either “Use Pay Reference period or “Use Tax Year“

IRIS GP Payroll

Go to “Setup/ Options” | “4 – Practice Pension Details” | “Auto Enrolment Details” | “Configure Automatic Enrolment”. For the option “AE Thresholds” select either “Use Pay Reference period” or “Use Tax Year”

Please Note: This functionality is not available in the PAYE-Master software.

Important Exception: If the employee is a New Starter or has their 22nd Birthday,their Assessment date will be their Start Date or birthday. If this date is in the previous tax year, the qualifying earnings lower limit will be £116. If the date is on or after 6th April, the qualifying earnings lower limit will be £118.

Pension Percentage Deduction Rates

The pension percentage rate increase is to be actioned from any payroll date on or after 6th April, regardless of any PRP. However, there is no percentage rate increase for the 2020/21 tax year.

For help uplifting your pension contribution rates please click here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.