Overview of changes for 2020/21 tax year

Article ID

12213

Article Name

Overview of changes for 2020/21 tax year

Created Date

11th March 2020

Product

IRIS PAYE-Master, Earnie, IRIS Payroll Professional, IRIS GP Payroll, IRIS Bureau Payroll, IRIS Earnie IQ, IRIS Payroll Business

Problem

Here we will breify discuss some of the provisional changes for the 20/21 tax year

Resolution

Contents

- Statutory Parental Bereavement Pay (SPBP)

- Off-Payroll Working

- Company Car Changes

- Holiday Pay Module (Earnie & Earnie IQ)

- Employment Allowance (EA)

- Termination Payments and Sporting Testimonials

- Provisional PAYE Rates 2020/21

Statutory Parental Bereavement Pay (SPBP)

Employees will now be entitled to two weeks’ leave following the death of a child, which subject to meeting the relevant criteria, will be paid at the statutory rate.

- Leave can be taken as a two week period or split into two seperate individual weeks

- Employees can have more than one instance of SPBP at anytime

- Eligibility starts from 24 weeks of pregnancy

- Must be taken within 56 weeks of death

- 26 weeks of employment service is required for eligibility.

Provision will be made via payroll software changes to allow for the payment and repoting of this new type of statutory payment.

Off-Payroll Working

Following the last-minute announcement by the Government, in-light of the recent Covid-19 outbreak, the legislation for implementation of the Off-Payroll Working (IR35) in the private sector will be delayed until April 2021.

See www.iris.co.uk/IR35 for more details

Commonly known as IR35, new Off-payroll legislation allows HMRC to collect tax & NI from the employer, where a worker provides their services through an intermediary.

The fee payer, public authority, agency or third-party who is responsible for paying the worker’s intermediary must:

- Calculate a deemed direct payment to account for the employment taxes associated with the contract

- Deduct those taxes from the payment to the worker’s intermediary

- Report taxes deducted to HMRC through RTI, Full Payment Submissions (FPS)

- Pay the relevant employer’s NICs

The fee payer, public authority, agency or third-party who is responsible for paying the worker’s intermediary must NOT:

- Deduct student loan repayments

- Deduct Auto-enrolment contributions

- Pay statutory payments

Provision will be made via payroll software changes to allow an employee to be idetified as an Off-Payroll worker enabling correct reporting via RTI.

Please Note: This functionality will not be available in GP Payroll or PAYE-Master software.

Following the last-minute announcement by the Government, in-light of the recent Covid-19 outbreak, the legislation for implementation of the Off-Payroll Working (IR35) in the private sector will be delayed until April 2021.

See www.iris.co.uk/IR35 for more details

Company Car Changes

Tariffs are changing to encourage the use of electric and low-emissions vehicles.

Further detaails will be availaible in the product specific guides when they have been updated for the new tax year.

Please Note: Company car functionality will continue to be unavailable in GP Payroll or PAYE-Master software.

Holiday Pay Module (Earnie & Earnie IQ)

The period for calculating Average Weekly Earnings for holiday pay is increasing from 12 to 52 weeks.

Employment Allowance (EA)

Businesses with employees can reduce their annual National Insurance Contributions by up to £4000 with Employment Allowance.

- From tax year 2020/21 Employment Allowance can only be claimed by businesses and charities with an Employer National Insurance Contributions bill below £100,000 in the previous tax year.

- From tax year 2020/2021, you must send an EPS in month 1 if you are continuing to claim EA

Business are unable to claim Employment Allowance if:

- If that EA claim would push them above the De minimis state aid threshold applicable to their industry sector

- You are the director and the only employee paid above the Secondary Threshold

- You employ someone for personal, household or domestic work (this does not apply to care/support workers)

- You are a public body or business doing more than half your work in the public sector, unless you are a charity

- You are a service company working under IR35 rules

Termination Payments and Sporting Testimonials

Employers must pay Class 1A NICs on any part of a termination (redundancy) payment exceeding the £30,000 threshold.

Sporting Testimonials

A sportsman may qualify for a one-off tax exemption of £100,000 on the income received if:

- They are an employed sportsperson

or

- They are a previously employed sportsperson and the testimonial relates to that employment

- The testimonial or benefit match is non-contractual or non-customary

- The events are held during a single testimonial or testimonial year

- The events are controlled by an independent person There has been no previous testimonial income to which the exemption is applied

Provision will be made via payroll software changes to allow for the payment and reporting of this type payment.

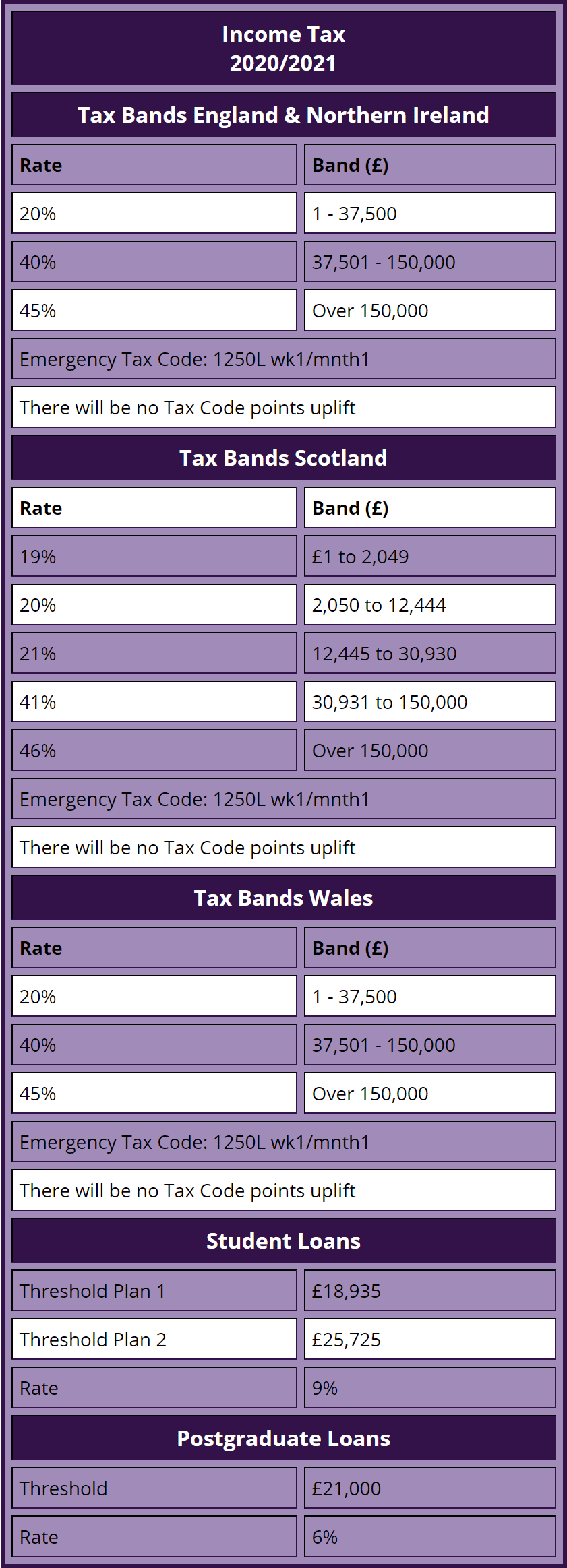

Provisional PAYE Rates 2020/21

Income Tax

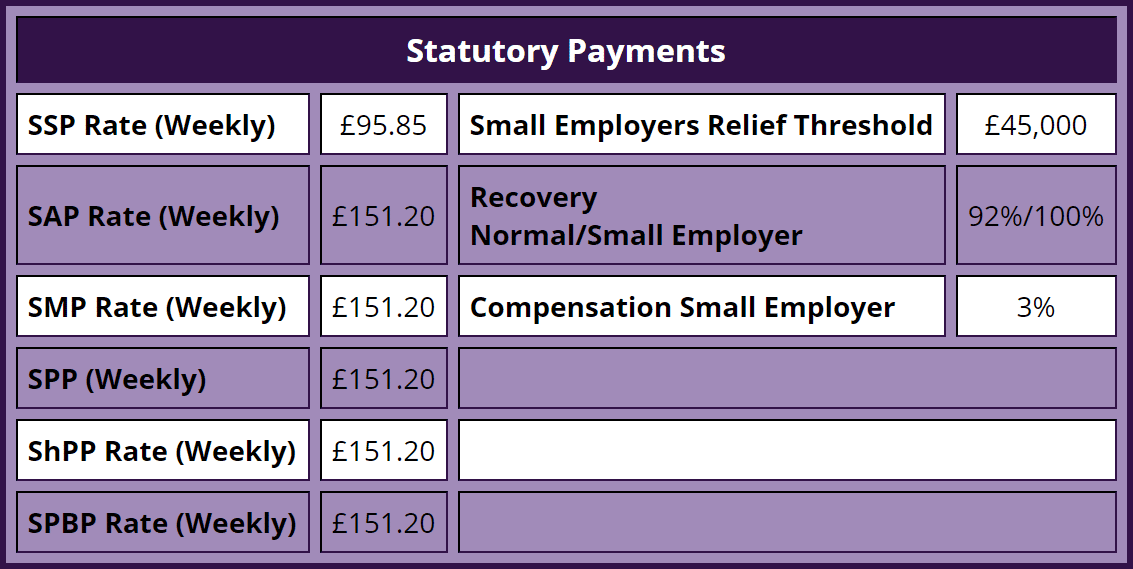

Statutory Payments

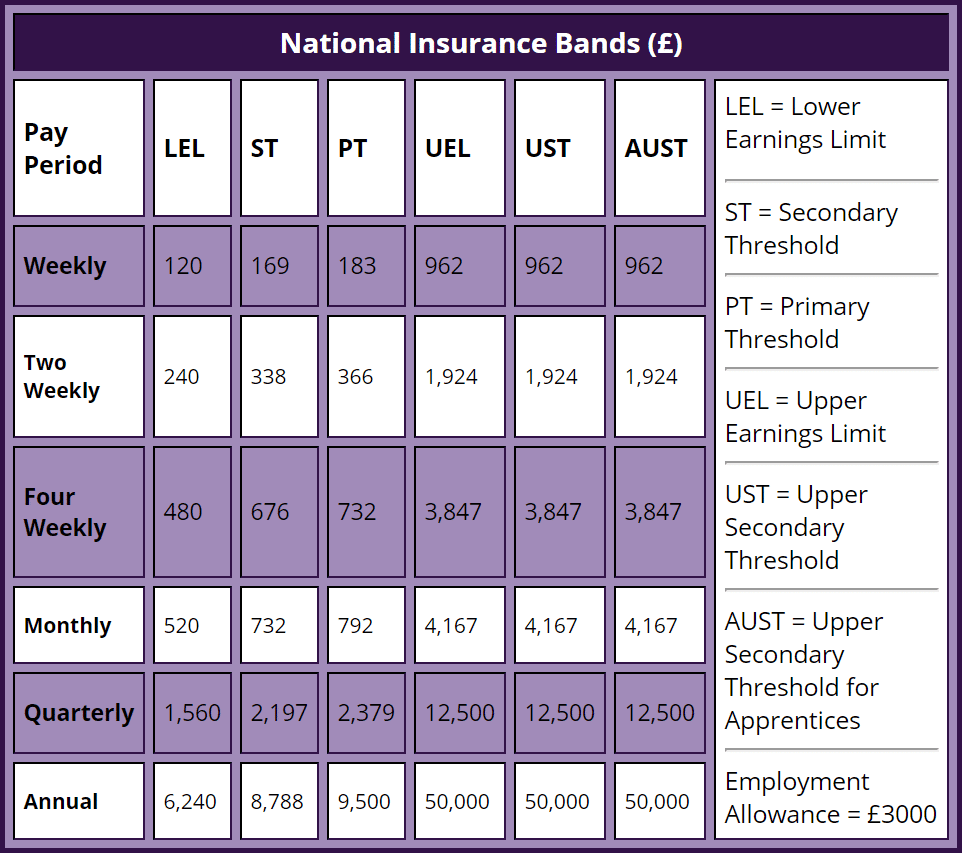

National Insurance Thresholds

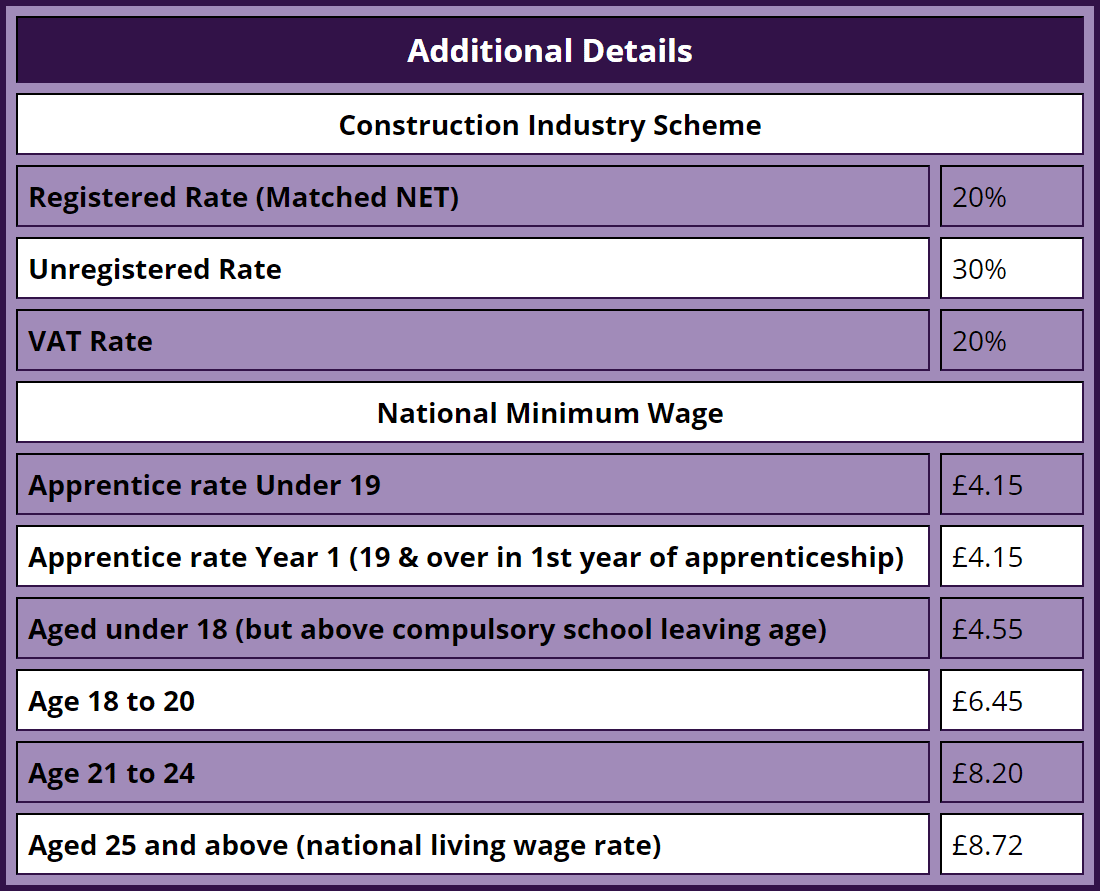

Additional PAYE Details

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.