No entitlement to SSP when recording sick period in employee diary

Article ID

8325

Article Name

No entitlement to SSP when recording sick period in employee diary

Created Date

1st June 2020

Product

IRIS Payroll Business

Problem

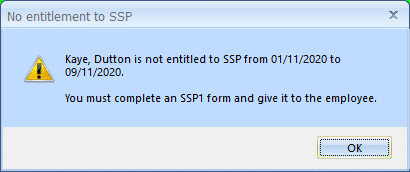

When entering a period of sick leave in the emloyee diary you receive a message:

Resolution

There are various reasons this might occur:

- Payroll needs 8 weeks’ previous gross pay to average and check the employee is entitled to receive SSP, i.e. The average pay is greater than the Lower Earning Limit. If this pay history does not exist you will see the No entitlement to SSP message. If the employees’ pay is going to be greater than the lower earnings limit you should still pay SSP, even though payroll cannot confirm they are entitled. In this instance, you will need to add the SSP payment manually on the employees’ pay variations.

- The employee has an average gross pay that is less than the Lower Earnings Limit. In this case they wouldn’t qualify for SSP. You would need to Issue the employee with an SSP1 form.

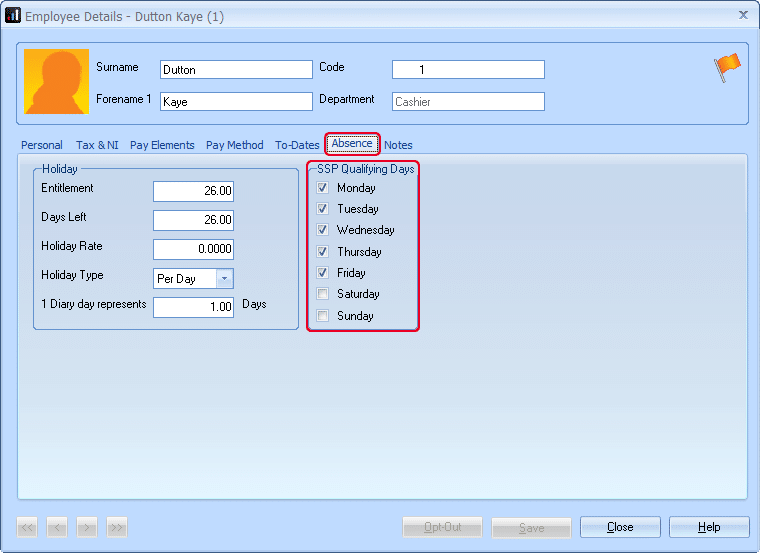

For more details on eligibility and the SSP1 form please read the guidance on gov.uk, click here. - The employee may not have 4 consecutive qualifying days. If the absence is less than 4 consecutive qualifying day it is not a period of incapacity to work. As such they would not qualify for SSP for this absence. If the absence does cover 4 consecutive working days, check you have the correct SSP Qualifying Days selected in Employee Details > Absence tab.

- You may have entered sickness into the absence diary and omitted the weekends or other non-qualifying days. If non-qualifying days form part of the period of incapacity, include them in the absence entry. Payroll will not count non-qualifying days as part of the SSP calculation but will use them to recognise a continuous period of absence.

See www.iris.co.uk/PAYELegisation for details of the current tax years various rates and thresholds.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.