Business Tax- 3001 9631 If Box L9 is completed or the return period start date in Box 30 is on/after 1 April 2022

Article ID

business-tax-3001-9631-if-box-l9-is-completed-or-the-return-period-start-date-in-box-30-is-on-after-1-april-2022

Article Name

Business Tax- 3001 9631 If Box L9 is completed or the return period start date in Box 30 is on/after 1 April 2022

Created Date

22nd April 2022

Product

Problem

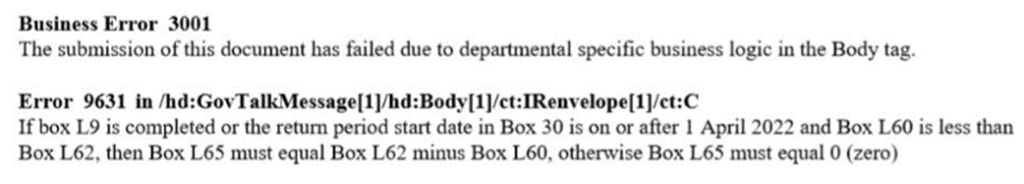

IRIS Business Tax: 3001 9631 If Box L9 is completed or the return period start date in Box 30 is on/after 1 April 2022, L65, L60

Resolution

This is a known HMRC issue. Please first update your IRIS version to the latest version – check by going to Help and About and Check for downloads. Once updated to latest version you need to regenerate the return, but if you still get the same issue then it will still be a HMRC issue.

HMRC have asked affected users, either to submit by paper to HMRC or wait for a fix from them (but they have stated no deadline of a fix).

Workaround: If you notice a penny rounding issue (eg between boxes L55/L65 etc) then BT is automatically rounding the values, You have TWO options 1) Include a rounded figure on the R&D claim OR 2) change the value then go to Data Entry – Research & Development (CT600L) – R&D Expenditure Credit – Tick the Box R&D Tax Credit – Manually change the value. If both do work OR there is no rounding issue, then you will need to submit by paper.

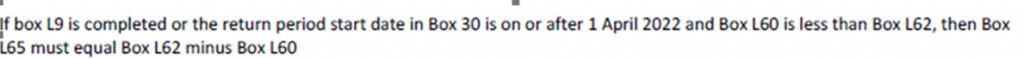

You may also get a validation error when generating like this:

CT600 Filing Validations – R&D – From 01 April 2021, all companies claiming the SME R&D Payable Tax Credit and or Research and Development Expenditure Credit will be required to complete the CT600L supplementary form. However, HMRC have identified several scenarios in which you may be unable to submit the correct figures on the CT600L due to a restriction within the HMRC Corporation Tax online service.

L65:

- If the accounting period start date is before 01 April 22, and the value in box L65 is greater than 0.

- Or if there is a value in box L35

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.