Business Tax: Claim 50% or 130% Super Deduction for Capital allowances

Article ID

business-tax-claim-50-or-130-super-deduction-for-capital-allowances

Article Name

Business Tax: Claim 50% or 130% Super Deduction for Capital allowances

Created Date

13th August 2021

Product

Problem

IRIS Business Tax: How to claim 50% or 130% Super Deduction for Capital allowances. PRE and POST 2023 rules

Resolution

On and after 2023: Super deduction is claiming at 128% instead of 130%, this is because Super deduction ended on 31/03/23, it will now apportion the rate as per the number of days available before 01/04/2023. HMRC link: https://www.gov.uk/guidance/super-deduction. If you have any more queries, please contact HMRC for more guidance.

Before 2023: This became available in Business tax in 2021 with the IRIS version 21.2.0 (Help | About to confirm version number).

Once you have updated to 21.2.0 or later then two new checkboxes are available under capital allowances to claim for Super deduction 130% (only for LTD) and 50% FYA special pool allowance which have been purchased between the 1st April 2021 – 31st March 2023.

IRIS will track these assets through their life and apply the specific disposal rules that apply to assets which have had the new Super Deduction FYA allowances applied.

This is only available to Limited companies that pay Corporation Tax, not Sole traders or business Partnerships.

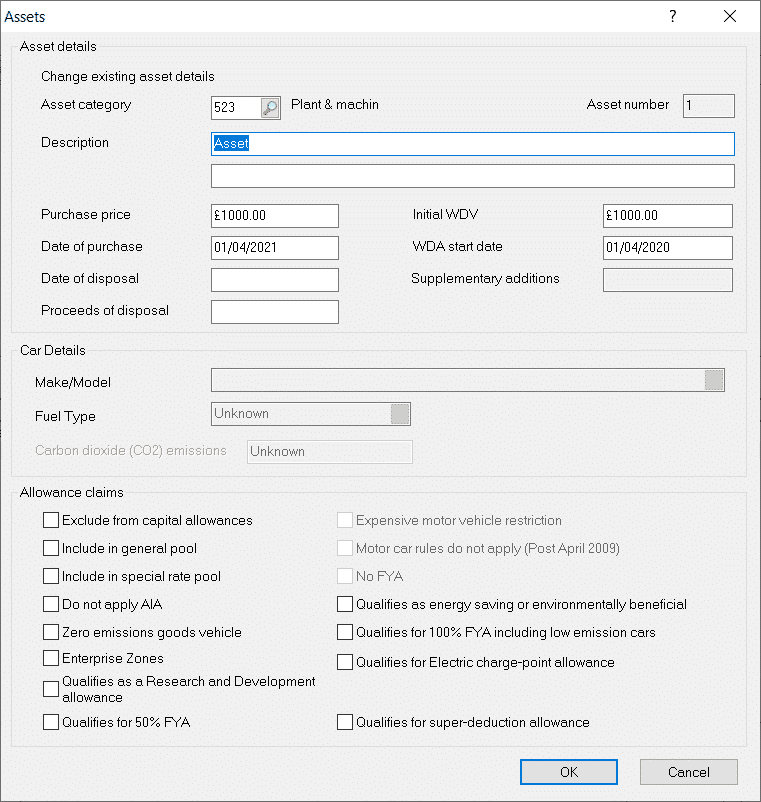

- Edit and Capital allowances.

- A-maintain assets.

- Create or open an asset with a date of purchase that falls within the rules – at the very bottom you can claim either option.

- The two options will only show under certain asset types. For example, 505, 522, 523, 524. If 525 then tick Motor car rules do not apply. If 526 then read HMRC rules: https://www.gov.uk/guidance/super-deduction

- If the 130% claim is missing from the Tax comp, then access the asset and untick Include in general pool and Save.

- If you have Car asset (525) and ticked Motor car rules do not apply and claimed super deduction, it will show on the tax comp correctly but if you open the asset again it will auto tick the ‘special rate‘. Just ensure you untick special rate and tick super deduction again.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.