Business Tax - Has detected that rogue Group relief records have previously been saved in IRIS database

Article ID

business-tax-has-detected-that-rogue-group-relief-records-have-previously-been-saved-in-iris-database

Article Name

Business Tax - Has detected that rogue Group relief records have previously been saved in IRIS database

Created Date

9th June 2023

Product

Problem

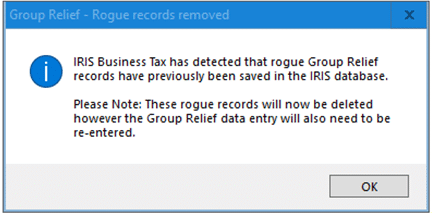

Business Tax has as detected that rogue Group relief records have previously been saved in the IRIS database

Resolution

When you access the Group and consortium and you get the warning: this means there is a incorrect transfer/claim entry between the original company (The one getting this error) and another company which can cause errors in the calculation. You have to identify this other company.

1.Check you are on the latest IRIS version – Help and About and Check for Downloads

2. Note down the company name which is getting the warning and also which other companies are linked to this original company. Either transferring loss from or giving a loss to. OR it had a Group and consortium claim in the past but no longer- so note down the past company name etc.

3. Load all the Companies in BT which are linked by the Group and consortium and check each of there Tax comps and Group and consortium screen

4. Once you have identified which companies are linked correctly – eg it shows the group relief/transfer details on both companies, then you can dismiss them from your checks. Then load the company which you know there should be a link BUT the other company doesn’t show up on Groups or Tax comp. Load this company which doesn’t appear for the other companies group/tax comp.

5. Go to Group and consortium – note down the details and value and delete this transfer/claim entry. Run the tax comp to make sure no values show.

6. Load back the original company and go to Group and consortium and enter the transfer/claim here (or you don’t if you believe its not a correct entry). Now run the tax comp for both companies and check.

For Example: After checking all the companies linked, we found there was one company causing this: the group relief loss was showing fine for one of the companies (Test LTD1) in group and consortium and on the tax comp.

But when we went into the original company and clicked on Group and consortium we got the error and then nothing was showing in Group and consortium or in the Tax comp with the details of Test LTD1.

Go back to (Test LTD1) and delete the group and consortium claim entry. Then go back into original company and enter in the correct surrender/claim of group relief within there. Then check both companies Tax comps etc and the message was no longer coming up anymore on the original company.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.