Business Tax: How to Carry back a loss up to 3 years for LTD?

Article ID

business-tax-how-to-carry-back-a-loss-up-to-3-years-for-ltd

Article Name

Business Tax: How to Carry back a loss up to 3 years for LTD?

Created Date

9th August 2021

Product

Problem

IRIS Business Tax: How to carry back a loss up to 3 years for a LTD?

Resolution

- Load the client in BT and ensure you are on the year of the loss

- Go to Edit in the top left hand corner and Losses

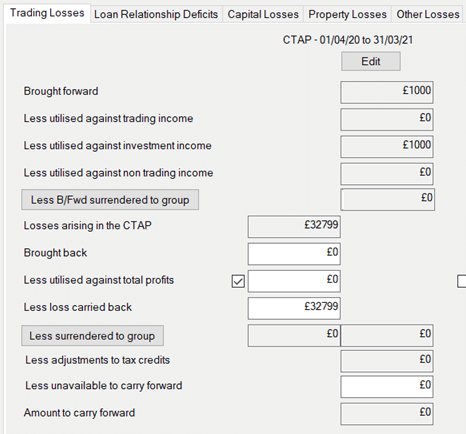

- In the current CTAP – enter the amount of losses you want to carry back in ‘Less Loss Carried Back’

- In the previous CTAP enter the amount in the ‘Brought Back’ filed • Click Apply and then OK

- Data Entry | Summary – in the top middle of the window – under Repayment claim – tick box ‘For earlier period’ (this will put a X in box 45 of the return)

- Finally go to Edit | Notes – in this window – enter the supporting narrative, for example; “X amount of losses was made in this period, X amount of losses is being carried back to previous X period, and that there is a repayment claim due”

- NOTE: If you have a carry back of losses missing from the Enhanced comp, but the basic does show this carry back. Check if the client was set up as a ‘Multiple Trade’ but only one trade was entered, if correct then the Enhanced comp cannot show it as its now looking for 2+ trade entries. As you cannot delete a multiple trade once set up, you can either create a new client and replace the extract and say “No” to replace the BTAX data and this will remove the Multi Trade but only on a new client OR just create the client again in AP/BT.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.