Business Tax- How to enter Associated Companies for CT600 and marginal relief box 326/329? (Also Box 35)

Article ID

business-tax-how-to-enter-associated-companies

Article Name

Business Tax- How to enter Associated Companies for CT600 and marginal relief box 326/329? (Also Box 35)

Created Date

10th July 2023

Product

IRIS Business Tax

Problem

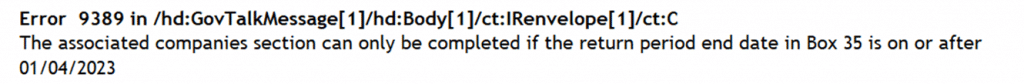

IRIS Business Tax- Associated Companies: box 326 and 329 etc Page 4 CT600. 3001 9389 Associated companies section can only be completed if return period end date in Box 35 is on/after 01/04/2023

Resolution

This includes known errors 3001 9389 and 9043, please read the very bottom of this KB.

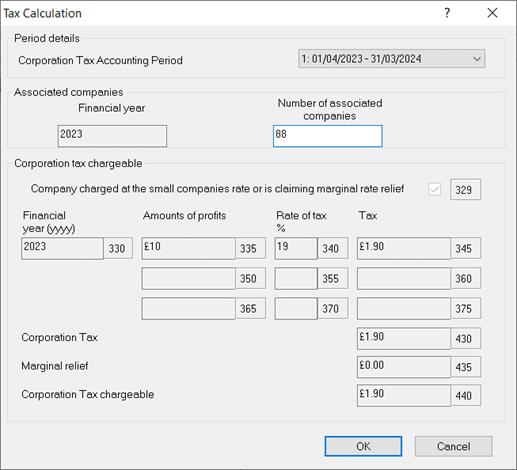

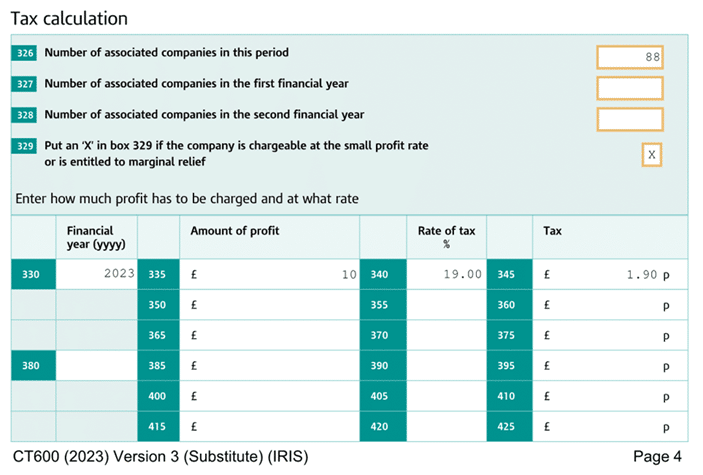

Post 2023 Associated Companies: Data Entry – Calculation – Tax calculation. Enter ‘Associated companies’ numbers to affect the marginal relief calc. These boxes only appears on Post April 2023 dates onwards (see image below). If under 50K: It will still use the 19% tax. If under 250K: It will give marginal relief to the tax calc, IF there are more ‘Associated companies’ then it lessens the tax threshold. It will show on the tax comp as a line named ‘Less marginal relief’.

How to check/query the BT marginal relief calculation: HMRC have their own calculator here

If there is no profit: then box 326 etc will be empty and also check dates as its only after post April 2023 (see below on box 326)

Split periods, gives you two boxes to enter: For Example you have a 2023 and also a 2024 box showing- check the dates as it will apply based on the period dates even if the one of the periods HAS NO entry made (i.e. only 1 period has an associated company entry). Also note if you have different associated company entries between the TWO split periods, then the highest number of companies entered will be used in the calc. (The HMRCs own calculator only has one company field which can be entered for the calculation). For Example: To see two years you would need a CTAP that straddles 01/04. If the period were a calendar year say 01/01/2024 to 31/12/2024 then this would be showing FY 2023 and FY 2024 on one screen. If there is only one Financial Year in the CTAP (eg 01/04/2023 to 31/3/2024) then only 1 year will be showing, extending it will only show a single year box on 1st year and a single year box on the 2nd year.

How many associated companies should i enter in? From the HMRC site: ‘You must enter the number of companies associated with your company for any part of the accounting period if either the: company’s profits are chargeable at the small profits rate. company is entitled to Marginal Relief‘. If this is unclear if it’s the TOTAL of all companies or excluding the one you are on then you will need to contact HMRC support on what they recommend.

Box 329 (For marginal relief) will be automatically ticked dependent on the accounting period, the level of profits and the number of associated companies. For periods straddling or starting on or after 1 April 2023. The profit would need to be within £50K to £250K range (these thresholds will be apportioned based on the length of the AP and by the number of associated companies). If profit is low enough it will also trigger 329 (see box 345).

3001 9389 Associated companies section can only be completed if return period end date in Box 35 is on/after 01/04/2023. Check if its a long period, is there is a 51% entry made possibly in one of the periods? if yes then this is a known error and our Development team is looking for a fix, we recommend this workaround, Data entry/calculation/ Indicators and remove the 51% grp companies entry and add it as a note in Edit | Notes. So you can now submit with no errors.

3001 9043 Entry must agree result of Marginal Starting rate etc – Please read this KB

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.