Business Tax- Page 1 of CT600 indicates accounts/comp are attached - so you must attach

Article ID

business-tax-page-1-of-ct600-indicates-accounts-comp-are-attached-so-you-must-attach

Article Name

Business Tax- Page 1 of CT600 indicates accounts/comp are attached - so you must attach

Created Date

23rd July 2021

Product

Problem

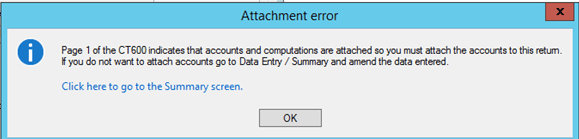

Iris Business Tax - When generating a CT600 you are getting this error 'Page 1 of CT600 indicates accounts/comp are attached - so you must attach the accounts etc'

Resolution

This warning means Business Tax cannot find the IXBRL html copy from Accounts Production (Or the Tax computation cant be found). It is defaulted to always look for a validated IXBRL from AP and the Tax comp (unless you tell it not to).

If the client is password protected, then BT wont pick it up automatically from AP. The ixbrl has to be attached manually in BT (see step 4).

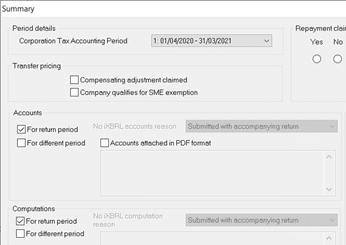

First check in BT: Data Entry/ Summary/ Accounts and the Computations: It should be ticked ‘For return period’ and the PDF format option is not ticked. The Computations should be ticked ‘For return period’.

1.Help and About. You must be on the latest IRIS version (Do not be on version below 21.2.0).

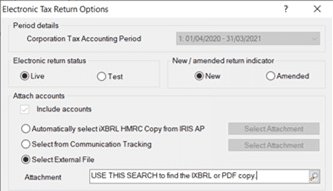

2. Data Entry, Summary, make sure the settings are similar to the image show above and click OK to save. Then regenerate the CT600.

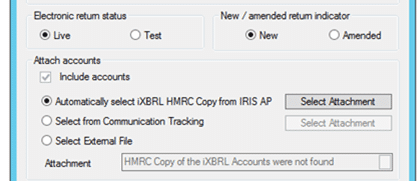

3. If you are already on the latest IRIS version: Data Entry/Summary/check if the settings are correct. If they are then start Accounts Production and load the client, regenerate and validate a IXBRL html again. Start BT and regenerate the CT600. If you get issue, then next to Automatically select Ixbrl HMRC- click ‘Select Attachment’ and find the Ixbrl from AP. If you cannot find it then go to Step 4.

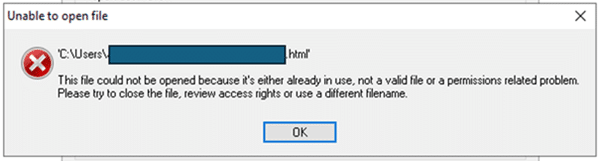

Check if you have the Practice Management License, if you do then there can be issues where PM is not saving the IXBRL in the correct location etc. You need to check if the IXBRL from AP are being correctly saved in the COMMS and DOCS area. You can check with the PM support team on this if all your IXBRL are missing/cant be found/cant be attached in BT. For example: If you try and attach a IXBRL in BT but you get an error then it could be a issue on PM because accounts IXBRL is stored via the PM system.

‘Unable to open file’ RED CROSS, first check where your IRIS data is saved (C\Users\…) and if you and other users have permission access to it and no one else has that file opened. If there are no issues then regenerate the IXBRL again in AP but save it externally and attach it manually in BT (Select External File as mentioned on this KB). However if all users and clients are affected where it cannot pick up the IXBRL from AP then do contact the Tech and PM teams to check your setup.

4. If option 3) does not work then start Accounts Production and load client, regenerate and validate a IXBRL html and save it externally on your pc or secure folder. Start BT and regenerate the CT600 and use the ‘External File’ and click the Magnifying glass to find the IXBRL file.

5. If option 4) does not work then start Accounts Production and load client, regenerate and validate a IXBRL html and save it as PDF externally on your pc or secure folder. Start BT, Data Entry, Summary – Accounts- tick PDF and select PDF option from the pull down list. Regenerate the CT600 and use the ‘External File’ and click the Magnifying glass to find the PDF file.

If you need to attach the Tax comp as a PDF – then read the KB below How to attach PDF of IXBRL or Tax comp to a CT600.

I don’t have a IXBRL from AP or I have a IXBRL from another source

HMRC are expecting a IXBRL (unless you have a valid reason not to, read further below) so you must have the IXBRL ready OR a PDF of the accounts saved. See below if you have the PDF prepared.

I have a PDF copy of the accounts

Data Entry, Summary – Accounts- tick PDF and select PDF option from the pull down list (for example: PDF accounts attached with explanation). Regenerate the CT600 and use the ‘External File’ and click the Magnifying glass to find the PDF file.

Valid reason why you cannot attach a IXBRL or PDF (Liquidated, dormant etc)

Data Entry, Summary – Accounts- tick PDF and select PDF option from the pull down list (Company in liquidation, company dormant, amendment etc). This will stop BT from trying to find a IXBRL or a PDF of the accounts.

How to attach PDF of IXBRL or Tax comp to a CT600– https://www.iris.co.uk/support/knowledgebase/kb/business-tax-how-to-attach-pdf-of-a-ixbrl-when-generating-ct600/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.