Business Tax- Post 01/04/2023 R&D SME and Intensive tax credits at 14.5 or 10%

Article ID

business-tax-post-01-04-2023-rd-sme-and-intensive-tax-credits

Article Name

Business Tax- Post 01/04/2023 R&D SME and Intensive tax credits at 14.5 or 10%

Created Date

20th July 2023

Product

IRIS Business Tax

Problem

IRIS Business Tax- Post 01/04/2023 SME R&D and Intensive tax credits at 14.5 or 10%

Resolution

There are TWO rules applying for the R&D SME – one is set to 10% and another at 14.5%. You need to update to IRIS version 23.2.0 update LINK:

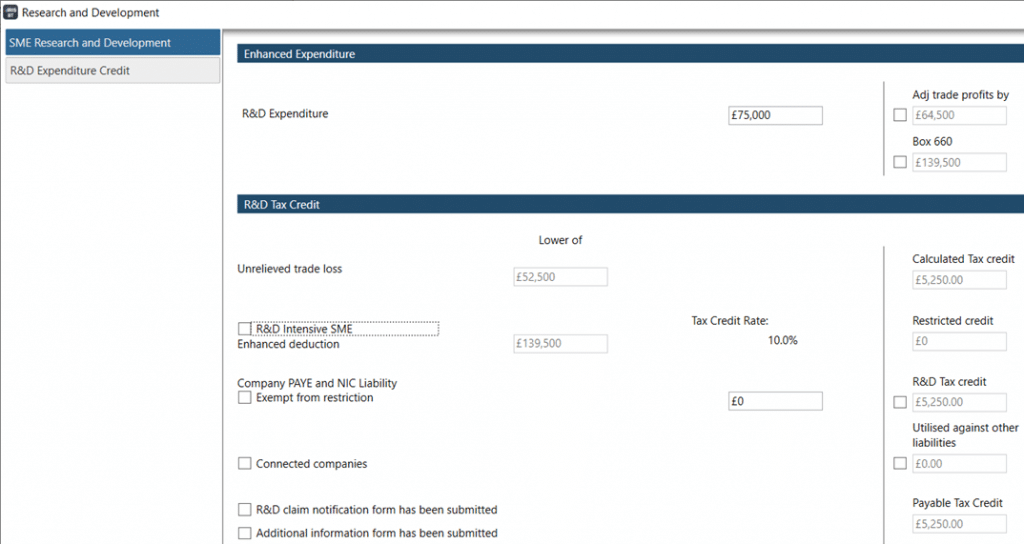

1.To claim 10%: The government announced that the tax credit rate for SME R&D claims would reduce from 14.5% to 10% for post 01/04/2023 periods.

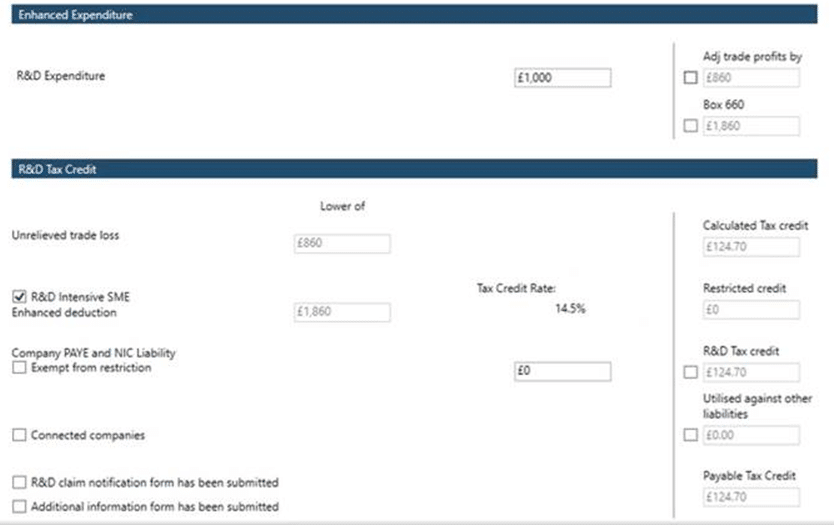

2. To claim 14.5%: In addition to this the government also announced a new SME tax credit for ‘R&D Intensive SME’ companies; companies whose qualifying expenditure is 40% or more will be allowed to claim an SME tax credit at an uplifted rate of 14.5%. This can be ticked on the R&D SME screen. When the checkbox is ticked the ‘Calculated Tax Credit’ field total for POST 01/04/2023 period will be at 14.5%.

We have updated the Business Tax R&D functionality to allow you to easily identify a company as an R&D intensive company and subsequently have the software automatically calculate the corresponding SME R&D claim at the uplifted 14.5%, without any additional manual calculations. This will then automatically map to the CT600 and supporting documents.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.