Personal Tax- How to enter Foreign/Partially Foreign (Self)-Employment or Partnership income

Article ID

ias-11676

Article Name

Personal Tax- How to enter Foreign/Partially Foreign (Self)-Employment or Partnership income

Created Date

19th June 2014

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- How to enter Foreign/Partially Foreign (Self)Employment OR Partnership income

Resolution

You need to make two separate entries:

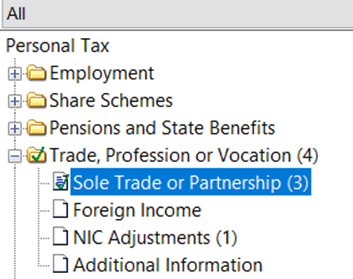

1. Load client in Personal Tax, navigate to Trade Profession or Vocation and then Sole Trade or Partnership. OR if Employment (earnings/foreign earnings)

2. Either double click on an already created Accounting Period, or click New at the bottom of the screen to set up an Accounting Period. OR if employment, open the business and enter in earnings etc and Duties Performed- and choose the relevant option.

3. Enter in the total amount of self-employed OR Partnership income, regardless of whether the trade has solely foreign income or both foreign and domestic income (so the combined total of the two)

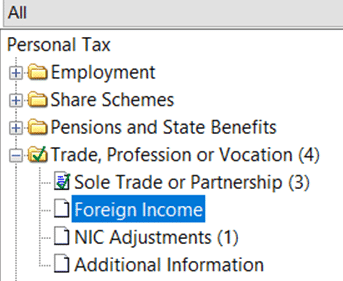

4. Navigate to Trade Profession or Vocation and then Foreign Income

5. Click New at the bottom of the screen

6. Enter in the total amount of the Foreign profit generated from this trade (even though this income was entered earlier into Sole Trade or Partnership) and all relevant detail. This tells PT which part is UK income and which part is Foreign income.

For example: If a self-employment trade had £5,000 domestic income and £5,000 foreign income, you would enter the total income of £10,000 into Sole Trade or Partnership and then the foreign £5,000 into Foreign Income within Trade Profession or Vocation. This is to show that out of the £10,000 total income, £5,000 is foreign. If the income is entirely foreign, you would enter the full amount in Sole Trade or Partnership and then the full amount again in Foreign Income.

I have Partnership income showing but i did not do step 3). Open the partnership, go to the ‘Other Untaxed income’ tab and the other tabs for the exact value of the income, for Example: if you make a entry under Foreign income ‘Allocated profit’ then it will also appear in the Tax comp etc This will also show as untaxed under the Schedules of Data report.

Unknown Partnership ‘Loss to Carry Forward‘: Trade profession or vocation, Foreign income, if you enter a ‘Foreign tax paid’ with no income under partnership (step 3) then this value will appear as a loss. It will not show this breakdown under the Trade comp.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.