IRIS Accountancy Suite: Agent details not showing on 64-8 form or greyed out

Article ID

iris-accountancy-suite-new-2022-64-8-form

Article Name

IRIS Accountancy Suite: Agent details not showing on 64-8 form or greyed out

Created Date

1st April 2022

Product

Problem

IRIS Accountancy Suite: Agent details not showing on 64-8 form in PT, BT and PM etc. for CIS/Employer PAYE OR 64-8 is greyed out

Resolution

Post 2024 New 64-8 Form: The IRIS Development team is designing the new 2024 form to be included into a later IRIS version (after version 24.3.0) – if you need access to the form then please use the HMRC link here . Why it was not included sooner? We have to wait for HMRC to inform us of any news changes/updates to the forms.

Agent details not showing on 64-8 form under CIS / Employer PAYE scheme OR cannot fill in Agent and PAYE boxes

If the actual 64-8 button is greyed out – You cannot produce a 64-8 for a Charity type and Other type and would need to create a limited co and complete or alternatively print of a blank 64-8 and manually fill it in.

If the actual 64-8 button is greyed out as well as all other buttons next to it – Eg Tax Summary and Marriages, then contact the IRIS Practice Management team.

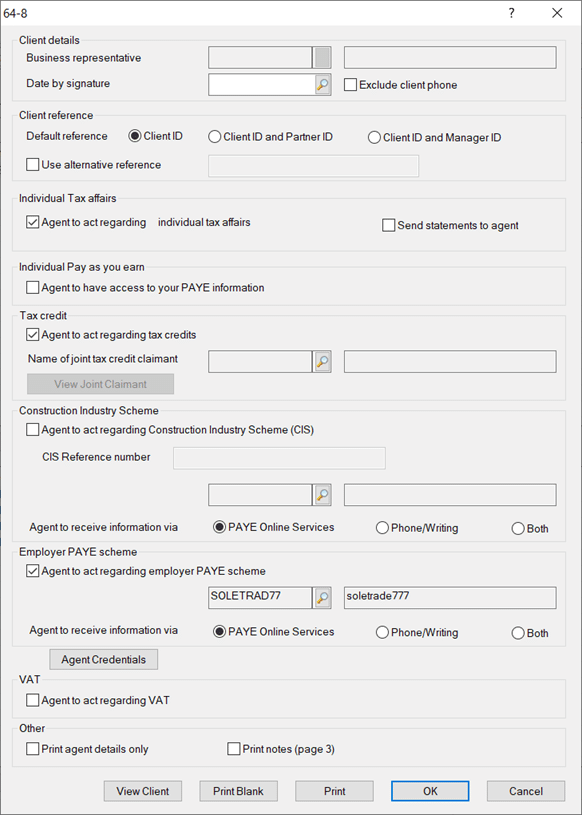

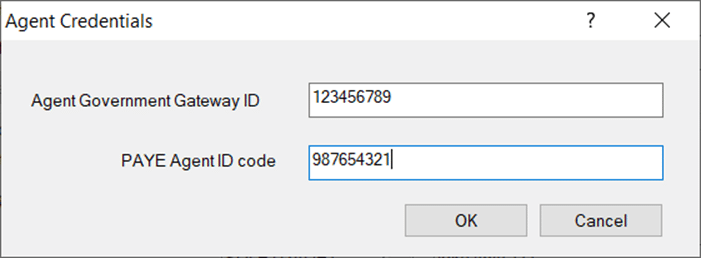

If you have a trade created for the client (for example a Sole Trade business) and you get to this screen – tick the CIS or PAYE tick box and click ‘Agent credentials’ and fill in the agent details. If the trade has ceased then these 2 boxes for agent and PAYE will be greyed out.

If you have multiple trades: the boxes will be empty (as it can only show one trade), tick the magnifying glass and click the relevant trade.

If you have no trade business: then the CIS and PAYE boxes will be greyed out. Without a trade entry you would need to either submit a paper 64-8 or do the agent authorisation via How to use the Online Agent Authorisation to get authorised as a tax agent – GOV.UK (www.gov.uk).

The Agent ID box (12 limit) and PAYE Agent box (32 limit) have character/number limitations and cannot be exceeded.

If you have been given a Agent ID code longer then 12 digits then you will need to contact HMRC support on which 12 digits to use.

Client Name not showing on 64-8 form. This is because the character limit for the name field is currently being exceeded. The following fields in the client maintenance screen contribute to the name field on the 64-8:

- Title

- Initials

- Surname

Please shorten any of the fields mentioned and after any changes, the user will need to select save and then restart Personal Tax. The name will now show on the 64-8.

Print 64-8 form. Load PT, go to Client and View and 64-8 button

Post 2022 New 64-8 Form: Is released on IRIS Version 22.2.0. HMRC have advised that for new clients from April the new 64-8 (Post 2022 onwards) can be submitted, however they have also mentioned that the old 64-8 (Pre 2022) can still be used until October 2022. Note: The 64-8 is a paper form therefore it is not submitted online via IRIS Accountancy Suite and has to be sent by post. HMRC link to new 2022 64-8: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1063788/authorise_agent_64-8.pdf

NOTE: If you submit a Tax Return online, the 64-8 gets filed automatically with the Electronic tax return. So when you file the electronic tax return – the 64-8 gets generated and submitted as well

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.