Payment on account

Article ID

kas-0021

Article Name

Payment on account

Created Date

9th January 2021

Product

IRIS Keytime, IRIS Keytime Personal Tax

Problem

Payment on account

Resolution

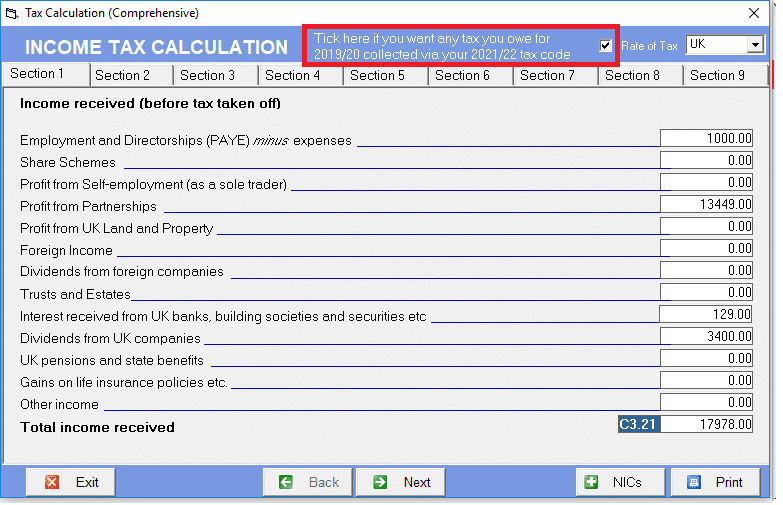

Override payment on account to be collected through tax code

To override payment on account to be collected through the clients tax code you will need to go to calculate and tick the box at the top of the calculation screen that says ‘Tick here if you want any tax you owe for 2019/20 via your 2021/22 tax code’ (the year would depend on what tax year you are completing).

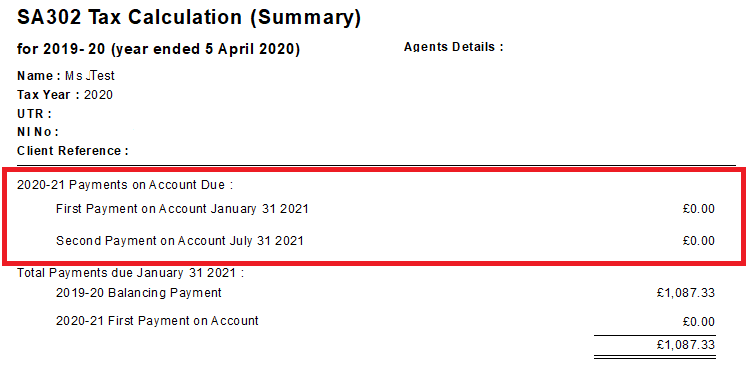

Then click calculate and go onto the second page of the SA302

This will show no Payment on accounts due, however there are certain conditions in which payments can be taken from the tax code. Please see below:

- you owe less than £3,000 on your tax bill

- you already pay tax through PAYE, for example you’re an employee or you get a company pension

- you submitted your paper tax return by 31 October or your online tax return online by 30 December

You will not be able to pay your tax bill through your PAYE tax code if:

- you do not have enough PAYE income for HMRC to collect it

- you’d pay more than 50% of your PAYE income in tax

- you’d end up paying more than twice as much tax as you normally do

Please refer to the following link for more information: www.gov.uk/pay-self-assessment-tax-bill/through-your-tax-code

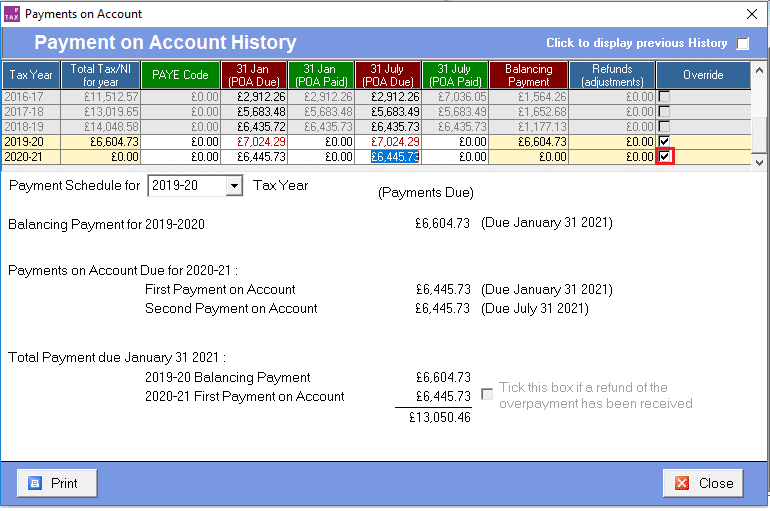

Adjust payment on account

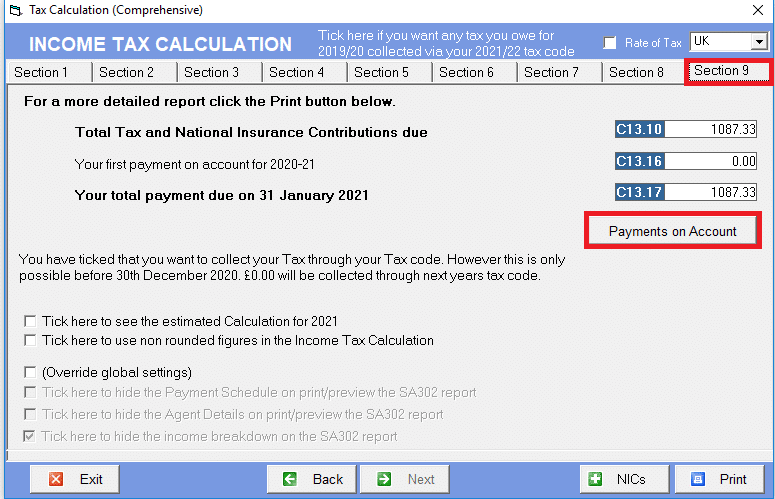

Click calculate, go to section 9 and click Payment on account

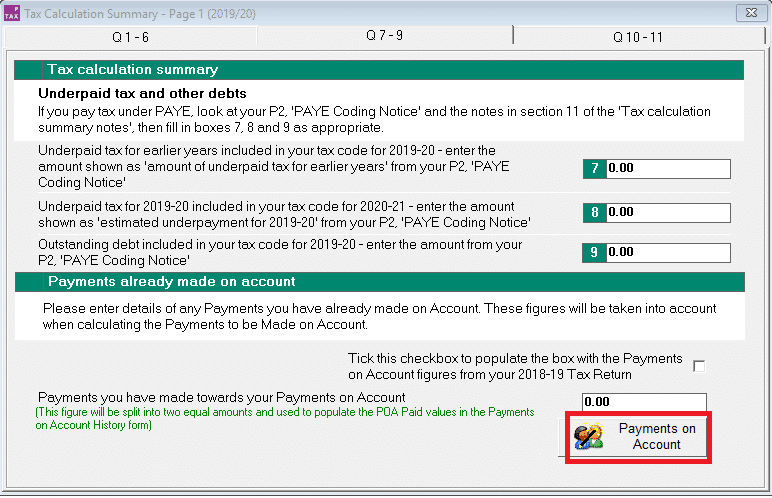

Alternatively, you can go into the Tax calculation summary page 1, q 7-9 and click Payments on account on that screen

You can then tick override, and select the amount you want to override and change the figure, closing out of this screen with save the figure.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.