PTP TR - entries in boxes 2 and 3 on TR6 for amounts to be collected via the tax code

Article ID

kba-03348

Article Name

PTP TR - entries in boxes 2 and 3 on TR6 for amounts to be collected via the tax code

Created Date

29th May 2015

Product

Problem

How can a cross be entered/removed from these boxes?

Resolution

Boxes 2 and 3 on page TR6 are not manual entry boxes. They are controlled by the settings selected in the Calculation window.

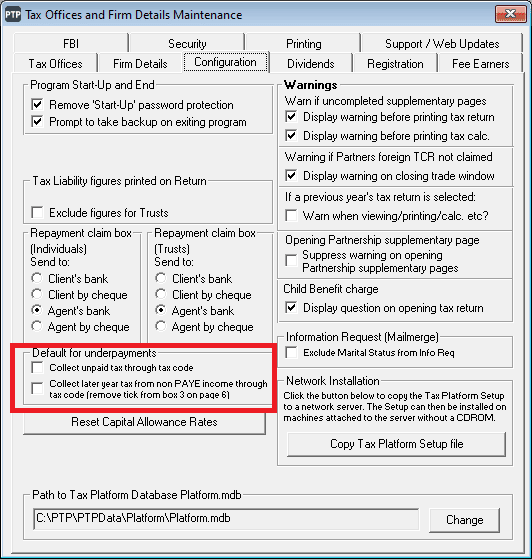

Firstly there are two default settings in the Spanner icon, in the Configuration tab, under a heading of Default for Underpayments. The first relates to box 2 and the second relates to box 3 on page TR6.

These should be set according to the wishes of the majority of your clients (they can be overridden for individual clients as per the instructions below). If the majority of your clients do not wish to have any tax collected through the code then these default settings should not be ticked in the spanner icon, or vice versa.

To override the default settings for a particular client:

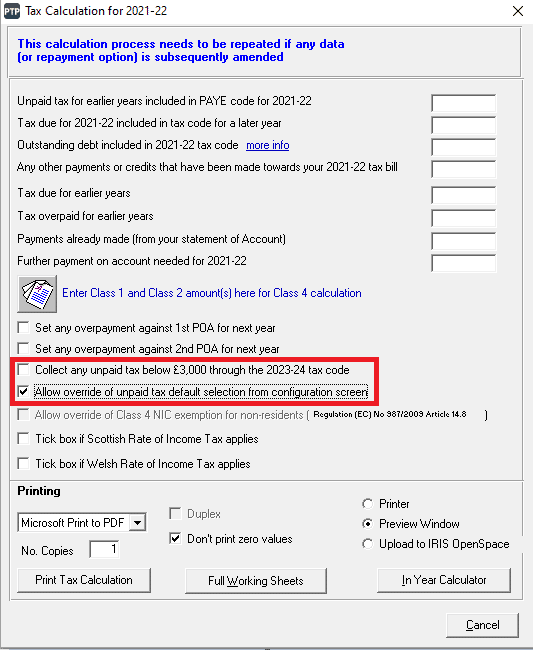

1. Press the Calculation button

2. Tick the box to Allow override of unpaid tax default selection from configuration screen

3. Amend the tick box(es) above it as appropriate to tick or untick the options relating to collecting any unpaid tax through the tax code

4. Proceed to run the tax calculation

5. Go back to page TR6 to view the settings

However there are some other circumstances that may also influence the population of box 2. If the amount of tax owed is greater than £3000, and therefore greater than the amount that can be collected via the tax code, the software will not put a cross in box 2 as it is deemed not relevant. Similarly if an amount has been entered in the calculation box for Payments already made or Further payment on account needed, and the amount entered would reduce the tax liability to nil, then the cross will not show in box 2 for the same reason. For the cross in box 3 to be present there must be entries in one or more of the following boxes/supplementary pages.

Boxes: On page TR3 boxes, 1, 2, 3, 4, 5 or 16 or on the Additional Information supplement and page AI1, boxes 1, 3, 12 or 13.

Supplementary Pages: UK Property Pages, Foreign Pages or Trust Pages.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.