PTP CT - Pre filing validations 9466 and 9469 re CT600A where loan was made on or after 6th April 2022

Article ID

kba-03816

Article Name

PTP CT - Pre filing validations 9466 and 9469 re CT600A where loan was made on or after 6th April 2022

Created Date

28th July 2022

Product

Problem

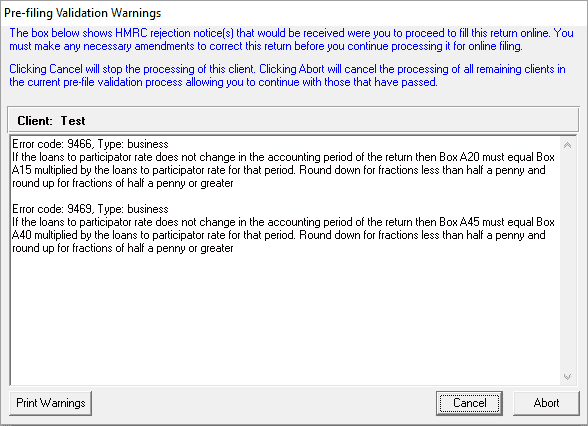

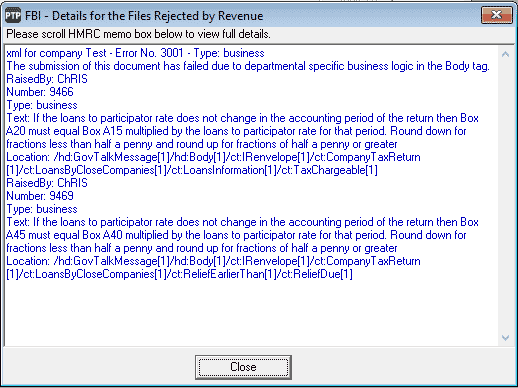

The Autumn Budget 2021 raised the rate of tax charged under section 455 on loans to participators from 32.5% to 33.75% from 6th April 2022. It is not yet possible to file these submissions online as it would give rise to pre filing validations or HMRC rejections with codes 9466 and 9469.

Resolution

The HMRC validations were updated in the Autumn release of PTP CT Platform, version 22.3.95 or later.

Note: If the Cancel button is pressed on the Pre filing validation screen it is possible to proceed with the submission. However, we recommend updating to the latest version.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.