P11D- 3001 7000 in IR header. You are not enrolled to submit under this reference OR 3001 5040 PAYE submission

Article ID

p11d-3001-7000-in-ir-header-you-are-not-enrolled-to-submit-under-this-reference

Article Name

P11D- 3001 7000 in IR header. You are not enrolled to submit under this reference OR 3001 5040 PAYE submission

Created Date

13th June 2022

Product

IRIS P11D

Problem

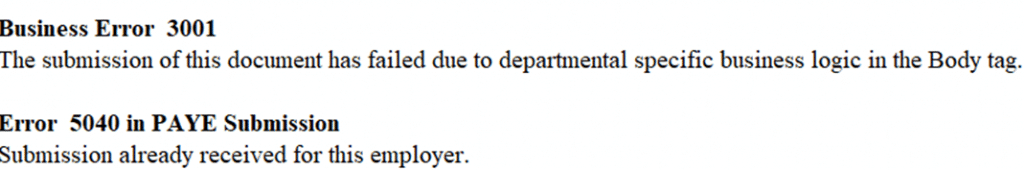

IRIS P11D: 3001 7000 in IR header. You are not enrolled to submit under this reference OR 3001 5040 PAYE submission

Resolution

Ensure your IRIS version is up to date – Help and About and check for Downloads

3001 7000 You are not enrolled to submit End of Year Returns under this reference:

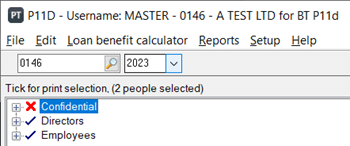

The Company PAYE code could be incorrect: Go to Top left of P11D – Client ID will show, select magnifying glass, find the company and View, Tax tab and check the reference number. If a PAYE reference – do not enter the First 3 digit PREFIX code along with the rest of the code- remove the 3 digits. The First 3 digit PREFIX code needs to entered in the PAYE District box. Then regenerate and submit.

If you do the update, check and regenerate and still get the same warning then this is a HMRC warning – you will need contact HMRC support. The error message means that your company is not authorised to submit returns for this client. HMRC will need to update their records in relation to this. If HMRC support says they do not have any issues on their side then speak to a senior.

3001 5040 PAYE submission:

HMRC have received an original return and you will have to send an amended P11D via the HMRC gateway (as HMRC wont accept amended online and now wont accept paper submissions). Read KB here

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.