P11D Error Code 3001 7979 or 7978 In cars

Article ID

p11d-error-code-3001-7979-or-7978-in-cars

Article Name

P11D Error Code 3001 7979 or 7978 In cars

Created Date

8th July 2021

Product

Problem

When trying to submit a P11D you will a error Code 3001 7979 or 7978 In cars - Must not be present if outside the co2 emissions range 1-50g.

Resolution

This is a new HMRC rule being applied in 2021 onwards causing that warning. If you have updated your IRIS version and still getting the 7978 error then follow the fixes below:

Warning: Check EVERY car in the relevant year and if you have brought forward cars from the past year as well – especially if they have ‘0’ CO2 entries – then follow the fixes below. 7979/7978 may not be caused by new cars entered in the current year but from brought forward cars, so every car must be checked.

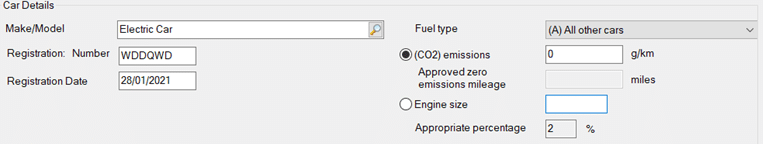

The reason that users are encountering this message is because of the “Approved zero emission mileage” field.

- If the field “(Co2) emissions” has a value between 1-50 then there must be a value entered in the field “Approved zero emission mileage”

- If the field “(Co2) emissions” has a value of 51 or over then the field “Approved zero emission mileage” must be blank and not have a value within.

- If it looks blank then a value below 50 can be entered in the field above just to enable it and ensure that the field really is blank, then re-enter the correct value in the “(Co2) emissions” field.

If there are any electric cars, please do the following: –

- Enter a Co2 amount of say ‘1’ in each of the zero emission cars which opens the box below it

- Then go to zero emissions box and delete the nothingness using your delete key and backspace key just to be sure. There can be a hidden value in here – which you need to delete

- Re-enter the zero co2 figure value again– this greys out the zero emissions – Generate and submit

There is a chance you will still get an error after you applied all these fixes as shown above. This has been reported in but rather than wait for a fix (which can take some time) and the P11d is correct then just submit it by paper to HMRC.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.