Personal/Business/Trust Tax - Failed Authentication, check Client UTR, ID and Password

Article ID

personal-and-business-tax-failed-authentication-check-client-utr-id-and-password

Article Name

Personal/Business/Trust Tax - Failed Authentication, check Client UTR, ID and Password

Created Date

13th July 2021

Product

IRIS Personal Tax, IRIS Business Tax

Problem

IRIS Personal/ Business/Trust Tax - submitting a tax return and get Failed Authentication, check Client UTR, ID and Password. BT error 1046

Resolution

Failed Auth if you recently edited your HMRC password in Nov/Dec 2024- for example you logged into your HMRC account and edited your password (remember not to use special characters) and saved it. You then go into IRIS, ‘Tax options’ settings to add in the new password which allows you to generate and submit a client online fine, however for the 2nd client even when you generated a new return and submit you get ‘Failed Authentication’. Please go back to Tax options settings and delete the ID and password, save and then go back in and type in the ID and new password in again, save, generate a new return and it can be submitted. Repeat these steps if you have a issue with the 3rd/4th etc client. This has been reported to the IRIS Development team who are investigating and we will update this KB once we have news.

If you are on P11D: read this KB https://www.iris.co.uk/support/knowledgebase/kb/p11d-failed-authentication-check-username-and-password/.

Error Code 1046 in Business Tax – please run all the checks listed below.

This Failed Auth warning means your HMRC Agent ID and/or password saved in your IRIS Accountancy is not recognised by HMRC when you submit (as HMRC will compare your details with the one saved on their systems). Please go through every step below to check and correct it.

1.You must be on the latest IRIS version – Help | About and Check for Downloads to update to latest version

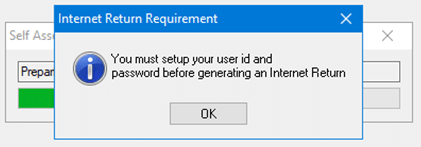

If you also haven’t entered an HMRC Agent ID/password, IRIS will automatically warn you. If you get this warning after submitting other tax returns fine then read the steps below especially the Agent/Alternative/Branch setup and recheck your entries in IRIS.

2. If on the latest IRIS version – Now regenerate the tax return again and submit it (if you do not do this then it remembers an old version/ID/password held within the Transmit Return screen).

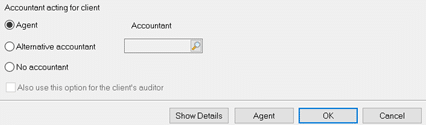

3. Client | View | Accountant – normally it should be set to Agent. If its set to Alternative or Branch then speak to your team to confirm if its correct, as ALT/Branch allows you to use a different HMRC ID/password to submit online. Read step 12 if its set to Alternative/Branch. Ensure it is not set to No Accountant or you wont be able to submit.

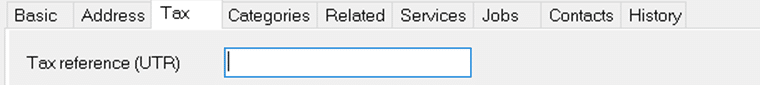

4. Client | View | Tax tab – check the clients ‘UTR’ code.

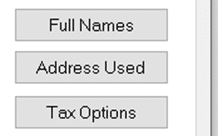

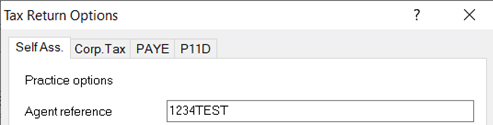

5. Setup | Practice options | Tax options on the right side (you may need to log in as MASTER user to access this).

6. Open the ‘Self Ass.’ or ‘Corp tax’ tabs. Are your Agent credential ID and Password correct? (Note: Trust tax uses the login details for Self Ass. tab and the Agent Reference box is only for your own ref and not used to submit), You can do a quick check on the password- tick the Self ass tab and then the Corp tax tab – look at the length of the hidden characters as one might be shorter then the other – if one is different, delete both and manually type in the password in both.

What is the agent ID?: This is the ID code you use to login to the HMRC website. Warning: HMRC may quote on a letter ‘Your Agent ID is= a 25 digit code is given’, this is NOT the correct ID code to allow you to submit online (you may even get this 25 digit code for Self Ass. AND Corporation).

7. You will now need to test this by logging into the HMRC gateway with the same ID and Password. If it logs in fine then go back to IRIS PT/BT and delete that ID and Password. Click OK and then go back in again re-enter it again carefully (do not copy and paste either code) and save.

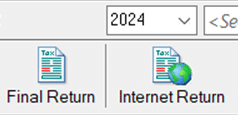

8. Do not submit right away (e.g in the Transmit Screen) as it remembers the old login details. YOU MUST regenerate it again to pick up the ID/password and then submit (click the Internet return button etc).

9. If it fails again then re-check your HMRC Agent Password. If it contains special characters (for example, £, $, %, ! etc.) then this can cause the issue.

10. Log in to your HMRC gateway and change the password so it only contains numbers and letters, save it. Then go back to step 5 and manually enter the updated password (do not copy and paste the password). YOU MUST regenerate the tax return again to pick up the corrected ID/password and then submit (click the Internet return button etc).

11. If it still fails then you need to call HMRC support and speak to a senior as there are issues where HMRC can block the submission from their side.

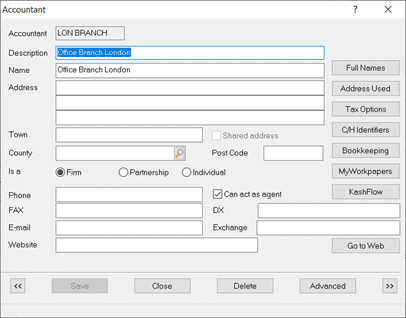

12. IF client accountant settings was set to Alternative or Branch

Alternative accountants are usually set up if a practice has several branches/offices which have their own Agent Credentials login details (that is, you don’t use one login for all the branches).

a. Client | View | Accountant. Set to Alternative and click the magnifying glass. Either create a new one or select an existing one.

b. You must tick ‘Can act as agent’ and click OK to save it and then click View on it again. More options will show (you may need to log in as MASTER).

c. Click Tax options and open the ‘Self Ass.’ or ‘Corp tax’ tabs. Complete the fields with the branches correct agent credential ID and Password. If it already has entries then delete it all, save, exit and go back in and manually type in ID/password again (do not copy and paste it). Also from Point 9) If the password contains a special character (for example, £, $, %, ! etc.) then this can cause the issue so see answer from point 9).

d. YOU MUST regenerate the tax return again to pick up the corrected ID/password and then submit (click the Internet return button etc).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.