Personal, Business, Trust Tax- How to Import a Client's Extract

Article ID

personal-business-trust-tax-how-to-import-a-clients-extract

Article Name

Personal, Business, Trust Tax- How to Import a Client's Extract

Created Date

12th November 2021

Product

IRIS P11D, IRIS Business Tax, IRIS Personal Tax, IRIS Trust Tax

Problem

IRIS Personal, Business, P11D and Trust Tax: How to Import an Extract into the IRIS tax?

Resolution

If you get the extract from eg another accountant/office then always check their IRIS version matches your IRIS version (Help and About) – if they do not match then it can cause issues when importing. For example Users on version 24.1.4.33 may have issues working with other users on earlier versions who try and import extracts (errors and missing data).

How to get a client extract – Load client in the tax program, client and extract/export or extract etc (If you need extract from BT client, then run these steps in AP). Choose where to save it on your pc etc and continue. It will appear as a XFR/BUP/XML file.

Warning for sender and receiver of extracts: Do not edit the extracts name when you save it to your pc. Eg if its originally named JSMITH.XFR, then don’t edit the name to MRJSMITH.XFR. as this can cause issues/errors when importing the extract. If you do need to edit the client ID then load the client and Client, View and ‘CHANGE ID’ and then run a new extract.

Personal Tax – the extract is called a XFR file eg JSMITH.XFR

- You will need a copy of the clients ‘XFR’ File saved onto your pc.(This XFR extract comes from- Client/export or extract) Note down the ID name

- If the client already exists in PT (has the exact same ID name as the XFR) – Load the client on PT, Client, Import, find the XFR file on your pc, and OK, say yes to the pop ups. Once completed now check the clients entries. But no data shows for this imported client: a common issue is that the ID code from the XFR is not identical to the ID, then you just created a new client so you now have 2 similar clients in PT (one has the data, the other has none) so please read point 3).

- If the client doesn’t exist or doesn’t match exactly the ID of the XFR, then a new client will be added into PT: Client, Import, find the XFR file on your pc, and OK, say yes to the pop ups. Once completed, go to Client, Select, search by the ‘ID code‘ and not the full name – you may also note two similar names from point 2), so delete or archive the one which is not the active client.

Business Tax /Accounts Production /Fixed Asset register – the extract is called a BUP file eg LTDCOMPANY.BUP

- This for importing data for BT/AP and FAR. You will need a copy of the clients ‘BUP’ File saved onto your pc (This BUP extract can ONLY be exported from Accounts Production and not from BT/FAR- by going to Client/export or extract). Note down the ID name and the business type (eg: LTD, Partner)

- Load Accounts Production. Before importing – The client ‘ID/name’ must already exist in Accounts Production (has the same ID name as the BUP your trying to import).Once you have created the business with same ID/name/type. Load the client on AP, Client, Replace, find the BUP file on your pc, and OK, say yes to the pop ups. Once completed, check if the Director, Partners etc. exist within the business (Client, View, Related and Involvements) – if they are missing then add them in and check the entries in AP.

- Also load the client in BT/FAR and check the entries.

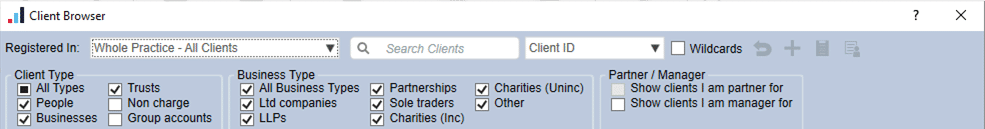

- I cannot find the newly imported client in BT/FAR?: Client, Select, Registered in: Whole Practice- all Clients. Now find the client.

Trust Tax – the extract is called a XML file eg TRUST.XML

- You will need a copy of the clients ‘XML’ File saved onto your pc. Note down the ID name and Trust Type

- Before Importing The client ID/name MUST already exist in Trust tax (It has the same ID/Type name as the XML). Once you have created the Trust with same ID/name/Type. Load the client on TT, Client, Replace, find the XML file on your pc, and OK, say yes to the pop ups. Once completed, check if the Trustees and beneficiaries etc. exist within the business (Client, View, Related and Involvements) – if they are missing then have to manually add them in, allocate any income between them all and check the entries in TT.

P11D extract – If the company already exists in AP/BT and the staff also exist in PT, then follow the steps for PT and BT to extract the XFR and BUP data (as you need the Client PT data and also the Business BUP data). Do ensure you import the PT clients first and then import the AP client data next. In the P11D, client select and choose ‘Whole practice all clients’ and find the company and load it. However if the company/staff data ONLY exists in the P11D – eg They do not exist in your BT/PT files, and you need to move the data to a new database/location then it is faster just to create it again as a new P11D company and manually add back in the employees/directors and benefits.

Import Extract and Crashes – When importing a XFR/BUP etc, the program crashes with no warning OR warning appears ‘library error-1’- PT/AP may also auto close, please reload PT/AP and now manually find the client from the client select list, when you load it then check all the income data is there. Also make sure you load the correct client ID as you could be loading the incorrect client which has no income data. If the client cannot be found: check where you got the XFR/BUP from (eg another party who also uses IRIS), then ask what IRIS version (help and about) are they on, it has to match your version of IRIS and then request a new XFR/BUP be sent to you. If they are on same version as you – ask for a new extract to be sent again.

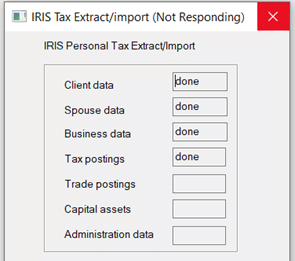

In PT for example, it may crash as this stage (from any of boxes, not just Tax postings)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.