Personal Tax: Allowable Business Expenses-group [SSE11-20] should not be present as there is an entry in [FSE16.1] or [SSE11-20] and 3001 8567

Article ID

personal-tax-allowable-business-expenses-group-sse11-20-should-not-be-present-as-there-is-an-entry-in-fse16-1-or-sse11-20-and-3001-8567

Article Name

Personal Tax: Allowable Business Expenses-group [SSE11-20] should not be present as there is an entry in [FSE16.1] or [SSE11-20] and 3001 8567

Created Date

7th April 2022

Product

Problem

IRIS Personal Tax: Allowable Business Expenses-group [SSE11-20] should not be present as there is an entry in [FSE16.1]

Resolution

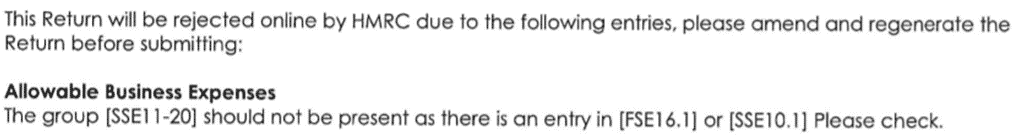

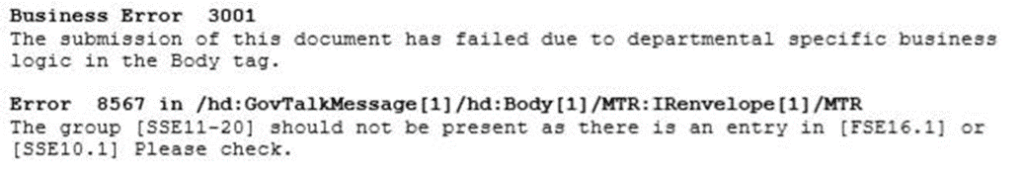

You will get the following errors when generating and and submitting a return, depending on how you have completed the fields mention in the message:

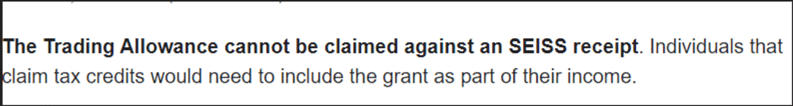

HMRC 2022 legislation on Trading allowance and SEISS claims

The Trading Income Allowance cannot be claimed against the SEISS grant. Therefore if you have claimed the SEISS grant then you cannot claim the Trading Income Allowance.

IRIS has fixed this on IRIS version 22.1.4.3 (which was released May 2022). There was a defect within Personal Tax whereby any user that is correctly claiming the Trading Income Allowance will not be able to submit the return online due to a schema change that HMRC has added for Tax Year 2022.

If you are on 22.1.4.3 and still getting the error – this is a known issue if you have TWO or more Sole Trade Businesses and one has claimed the trading allowance. Our development team has fixed this with IRIS version 22.2.0.

But if you have a urgent submission then use this workaround: Untick the trade allowance claim, go to expenses add in the £1K amount (under ‘other’), Then under reliefs add a note to HMRC stating this is really the trading allowance. Submit online to HMRC.

If you are on 24.1.0 etc and get a ‘Validation Trading Allowance FSE16.1 must be less or equal to’ then please update to IRIS version 24.2.0 which fixes this issue.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.