Personal Tax: Amount in box SSE10.1 must be less or equal to sum of SA103s net profit/SA103s Net loss etc

Article ID

personal-tax-amount-in-box-sse10-1-must-be-less-or-equal-to-sum-of-sa103s-net-profit-sa103s-net-loss-etc

Article Name

Personal Tax: Amount in box SSE10.1 must be less or equal to sum of SA103s net profit/SA103s Net loss etc

Created Date

19th October 2021

Product

Problem

IRIS Personal Tax: Amount in box SSE10.1 must be less or equal to sum of SA103s net profit/SA103s Net loss etc

Resolution

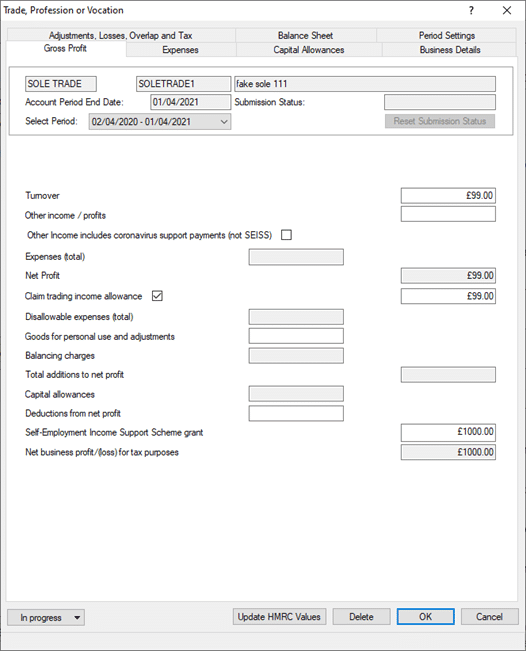

HMRC rule – The reason that the error is appearing is because the ‘trading allowance’ amount must be restricted to the amount of profit (cant be higher), please do the following to remove the error that is appearing:

- Login to personal and select the client

- Income | trade, profession or vocation | soletrade or partnership | double click on the end date | change the ‘Claim trading income allowance’ amount to the same as the income

- Regenerate the return

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.