Personal Tax- Child Benefit for High income tax earner- how relief is calculated?

Article ID

personal-tax-child-benefit-for-high-income-tax-earner-how-relief-is-calculated

Article Name

Personal Tax- Child Benefit for High income tax earner- how relief is calculated?

Created Date

1st August 2022

Product

Problem

IRIS Personal Tax- Child Benefit for High income tax earner- how the child benefit relief is calculated?

Resolution

1.Load the client in PT and relevant year

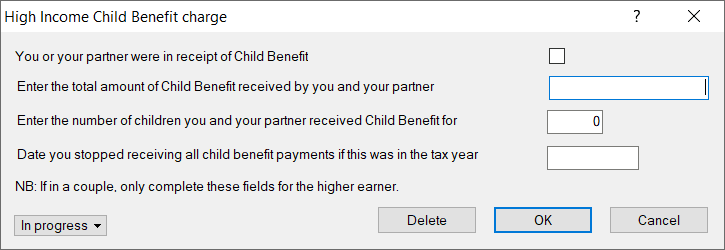

2.Reliefs/Miscellaneous and within this menu you will see High Income Child Benefit charge – enter details here

3. Reports – Run the ‘High Income child benefit computation’. This shows the HMRC rule on relief is applied – it will always use the lower amount between A and B.

Why is it missing the Child benefit from the Tax comp? Check if you also have any ‘pension contribution payments’. It will not show because of pension payments (following HMRC rules), as a test just remove the pension payments and then run the comp. Also check the amount of income – the relevant income must be over £50,000.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.