Personal Tax- Client 'Tax Code' adjusting the tax calc?

Article ID

personal-tax-client-tax-code-adjusting-the-tax-calc

Article Name

Personal Tax- Client 'Tax Code' adjusting the tax calc?

Created Date

21st July 2022

Product

Problem

IRIS Personal Tax- Client 'Tax Code' adjusting the tax calc?

Resolution

The client ‘Tax code’ entered into Personal Tax is just for information purposes it will not have any bearing on the tax comp and tax return.

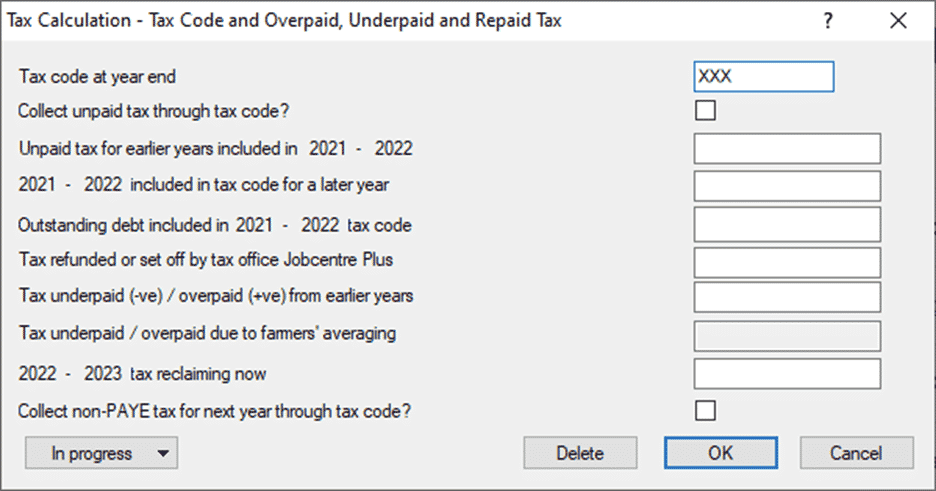

Reliefs, Misc, Tax code and overpaid…, Enter the ‘Tax code at year end’ at the top – this is only used for your clients internal data collation and it will not adjust the tax calc. You can test by changing the code – it will not affect the tax calc.

If you want to make an adjustment to the tax calc (due to Tax code change), you will need to contact HMRC support to enquire where they want this adjustment to show on the SA100 eg box and page number.

Use the ‘Tax underpaid/overpaid from earlier years’, to change the tax calc: the field for tax underpaid/overpaid should be entered only for the following reasons:

- A claim for farmer’s averaging has increased or reduced the income from the preceding year.

- A claim of backwards spreading of literary or artistic income increased the income from the preceding year(s)

- Post-cessation receipts are carried back to the year of the trade’s cessation.

- Losses are carried back and set against income of an earlier year.

- Additional personal pension contributions have been carried back to the previous year (or two years if there were no net relevant earnings in the intervening year). In other words, the contents of boxes 4.3, 4.8 and 4.13.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.