Personal Tax- Disposal of Property Capital gain(30/60 Days) and Tax already paid/charged

Article ID

personal-tax-disposal-of-property-capital-gain30-days-and-how-to-enter-tax-paid-on-it

Article Name

Personal Tax- Disposal of Property Capital gain(30/60 Days) and Tax already paid/charged

Created Date

21st July 2021

Product

Problem

IRIS Personal Tax- How to show a disposal of Property Capital gain (within 30 and 60 Days) and how enter Tax paid on box 9/10/11/12? Tax paid is also not being applied missing. This also applies to Trust tax with property gains.

Resolution

IRIS PT does not deal with the 30/60 day CGT reporting system (60 days of selling the property if the completion date was on or after 27 October 2021). Our development team have been looking into this, but unfortunately due to the HMRC servers not being available for this it is not possible to file via Iris as of yet. Until we get confirmation HMRC finished their server setup then IRIS cant do this work via our software. The CG34 form cannot be submitted online via IRIS PT.

HMRC has a dedicated site: https://www.tax.service.gov.uk/capital-gains-tax-uk-property/start/report-pay-capital-gains-tax-uk-property

How to enter Tax paid on the 30/60 day CG disposal. This also applies to Trust tax with property gains.

a) Dividends / Capital assets

b) Open the asset

c) Click property on bottom right or the magnifying glass

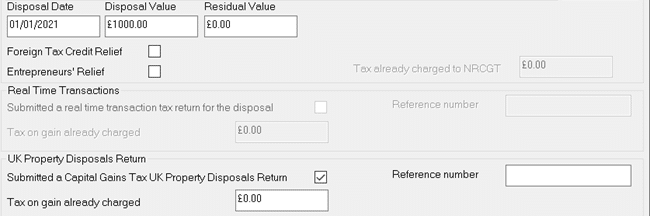

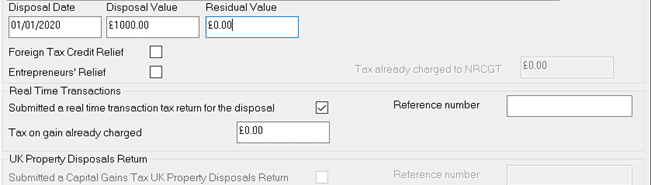

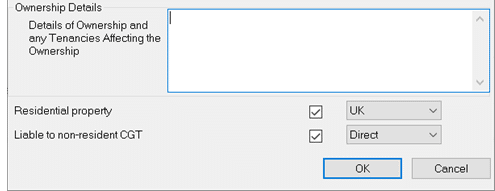

The combination you enter for residential/non residential and uk/non-uk- will permit the 2 types of ‘Transactions’ (Realtime or UK options). Trust tax ONLY has the one UK option.

If property, the option ‘Liable to non resident CGT’ if ticked, will open the Non Resident CG boxes and UK property Disposal boxes.

The Disposal Date also affects whether you can select Realtime or UK options – eg 2020 may not allow Real/UK. 2021 may allow Real/UK. You may want to test and change disposal year to see this. This rule follows HMRC requirements and cannot be edited.

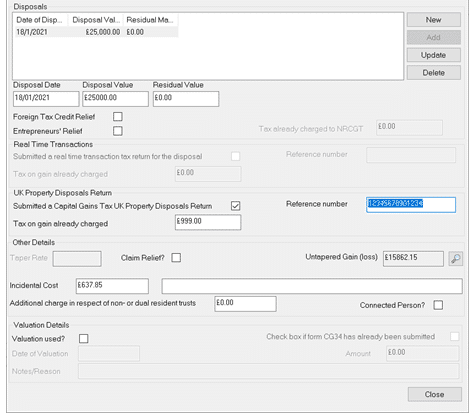

d) Go to the Disposals screen and select the relevant property disposal or create the disposal entry.

e) On the disposal section- the Real or UK options we mentioned above on step c) may open up (Remember to check the disposal date if this doesn’t show up). Enter the value and the reference number and update/save.

Boxes for Real time transactions: Fills in Boxes 11, 12 (Box 21,22 if its not ticked Residential).

Boxes for UK Property disposals transactions: Tick residential and set to ‘uk’ – Fills in Boxes 9,10.

f) Run the Capital Gains Tax comp if you want to view changes made with the ‘Tax paid’ value.

Tax already paid missing on CG comp etc: If you tick the ‘Liable for Non resident CGT’ (Open Asset and tick property), then following HMRC rules, the CGT comp will not deduct the tax already paid from the gains and boxes 9 and 10 will be empty. If you untick ‘Liable for Non resident CGT’, then it shall auto remove the entry made in the UK property box. The UK property box entry is only used for your internal bookkeeping.

Note: The ‘Reference code’ currently only permits 14 digits – if you have a 15 digit code then remove 1 digit from it and put in the full code under- Capital Assets, Edit, Losses and other info, Tick Additional Information and enter here. This appears on the CG pages.

Expecting a Underpayment or Overpayment calculation on the comp/tax return but its missing – link here: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-underpayment-or-overpayment-of-capital-gains-tax-how/

Be careful if you claim tax charged but the asset disposal has no GAIN or LOSS- link here https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-uk-property-sa108-tax-on-gains-box-9-already-charged-3001-8392-cgt10-present-cgt9-present/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.