Personal Tax- SA105/SA106 loss set off against total income should not be present PRO20.2 OR Furnished holiday let balance charge EEA absent/not exceed £150,000 OR 8056/8270/8526

Article ID

personal-tax-entry-in-box-sa105-loss-set-off-against-total-income-should-not-be-present-pro20-2

Article Name

Personal Tax- SA105/SA106 loss set off against total income should not be present PRO20.2 OR Furnished holiday let balance charge EEA absent/not exceed £150,000 OR 8056/8270/8526

Created Date

19th January 2023

Product

Problem

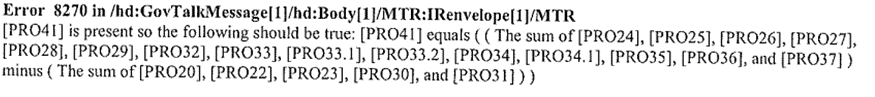

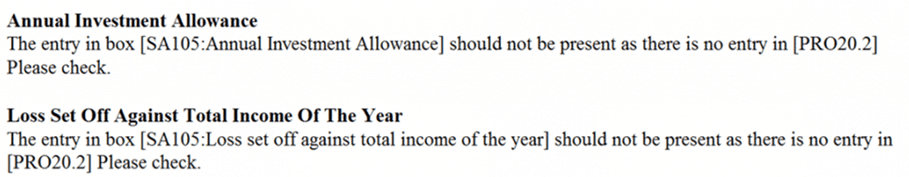

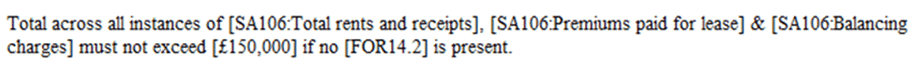

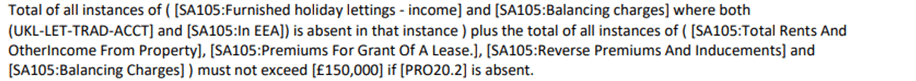

IRIS Personal Tax- 3001 8506 Entry in box SA105 loss set off against total income should not be present PRO20.2 OR EEA absent £150000 if PRO20.2 OR 3001 8270 OR 3001 8526 Error 8526 The entry in box (PRO32) should not be present as there is no entry in (PRO20.2). Please check.

Resolution

You may get several different type of warnings – there are 7 examples below, please follow the fixes:

3001 8506 Entry in box SA105 loss set off against total income should not be present PRO20.2 OR Total of all instances SA105 furnished holiday let balance charge EEA absent £150000 if PRO20.2 OR 3001 8270

Error 8526 The entry in box (PRO32) should not be present as there is no entry in (PRO20.2). Please check.

These errors are linked to UK and Foreign Property entries:

1.Go to UK Land and Property | UK Property Income AND also Foreign and Foreign property and check all property entries

2. Select the property at the top half of the screen

3. Tick box – Property profits have been calculated using traditional accounting rather than cash basis (If more than one property please do this for all of them). Regenerate and submit.

If that doesn’t work then make these checks:

1.You cant enter tax paid to a property which is making a loss

2. Check if the property has negative expenses, if so remove and enter as other income

3. If Foreign – Property Income – Edit – Tick ‘Furnished Holiday Let’ – Magnifying glass for country code – Select a country that says ‘Yes’ in EEA column

4. Round all expenses to the nearest even number

5. Read this KB on the rest of the checklist: go through all the steps

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.