Personal Tax- HMRC Data Retrieval Setup, error, not working, no data, not possible to connect

Article ID

personal-tax-hmrc-data-retrieval-error-not-working-no-data

Article Name

Personal Tax- HMRC Data Retrieval Setup, error, not working, no data, not possible to connect

Created Date

13th July 2021

Product

IRIS Personal Tax

Problem

IRIS Personal tax- Your clients data from HMRC is not showing or you get error when you click 'Retrieve HMRC Data' Is it not possible to connect to HMRC etc

Resolution

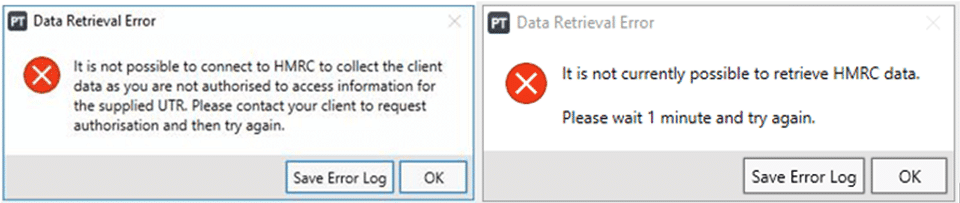

If No data for a client shows or you get similar warnings like this:

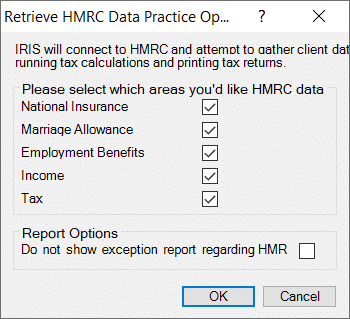

You must be on the latest IRIS version (Help and About + ‘Check for Downloads’) and check here: Setup/ Retrieve HMRC data practice options, the top five boxes must be all ticked.

Important note: HMRC data retrieval is completely dependent on the HMRC server having your clients data ready (if they do not have the data ready – you may not get any information yet) and they have authorised your Agent credentials. You may have done everything correct on your side in PT but the data just isn’t ready from the HMRC side.

What data shows: It only provides data for ‘Employment’, ‘Employment benefits’ and ‘Other pensions’ (in 2021 ‘SEISS’ data for sole traders was added in). Link: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-hmrc-data-retrieval-how-the-data-shows/ .

Steps to fix missing HMRC Data Retrieval:

1) Setup, Authorised agents. Highlight your name (initials or company name) with ‘pre-population’, Click Reset credentials and say yes. if you have the same name appear multiple times – read the very bottom of this KB.

Then close and click ‘Retrieve HMRC data’ and log in with your HMRC Agent credentials (the same ones you use to submit PT/BT tax returns and not the Agent Services Account) and answer the security questions about yourself or a nominated person in your team (Its not about your client). NOTE: Users can also use their HMRC ASA login instead of the agent login (ASA login is normally only used in the VAT Filer), however your clients must still be authorised from the HMRC side.

What is the Authorised date: The date next to pre-population is when it was last registered. If this date is between 12 to 18+ months old then there is a chance it will be automatically be unauthorised by HMRC. You will need to reset and log back in (step1).

What are the HMRC security questions: HMRC will continue to change or add new security questions every year about yourself (not your clients details). If you cannot answer a question which is required then you need to contact HMRC support. These questions are set by HMRC and are not from IRIS.

2) The client data should appear within 24/48 HRS. As it take some time for the HMRC to pick up your new login.

3) If you still have the same warning or no data then its very likely a HMRC issue – they have confirmed every year they normally finish compiling everyone data by the end of each year. This rule has not changed since the Data Retrieval was launched.

Reasons why you get no data for anyone or only for some people:

a. HMRC only start collating the data for every client from summer and only becomes more reliable later in the year. Trying to retrieve data in spring/summer is very random for most users until HMRC finish collating the data.

b. HMRC will keep updating their servers which holds the data. When they do this it causes data retrieval issues for users and the client data. But most likely it’s a issue where they simply haven’t got the data ready.

c. If its a very busy period like in January then the HMRC server could be overly used by other accountants using the same retrieval causing issues like no data/ incorrect data to show.

There are three actions you can do if you get no data:

a) Contact your client for the data (dependent if they can find it).

b) Keep trying to retrieve HMRC data every day/week etc. the data may come through later on.

c) Contact HMRC directly if they have the information. Do note their 1st level staff do not have access to this data and may say by default everything is correct on their side. You can ask to speak to a senior.

Note: HMRC will update their servers every year and it can disconnect your HMRC auth login. You may need to reset it and log back in. Also when you update IRIS to the latest version then you may also need to reset your HMRC authority again.

IRIS User Privilege– IRIS users can be set a privilege to use/not use the HMRC data function. Login as MASTER: Go to Setup/Staff Maintenance/ Find user and View/ Privileges tab/ Scroll down to Personal tax and tick/untick ‘Can retrieve HMRC data and alter setup’. If you untick it – This hides the HMRC data retrieval button (at the Top right) and blocks accessing the Options field 6 tick boxes at the top of PT(see image at the top of this KB).

‘Authorised Agent’- Identical names appears for Pre-population?: This is because you have multiple Alternatives or Branches setup with the same name – so you cannot tell which one is linked to which Alt/Branch. Read this KB:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.