Personal Tax: How to carry back Capital loss to previous capital gain?

Article ID

personal-tax-how-to-carry-back-capital-loss-to-previous-capital-gain

Article Name

Personal Tax: How to carry back Capital loss to previous capital gain?

Created Date

28th January 2022

Product

Problem

IRIS Personal Tax: How to carry back Capital loss to previous year capital gain? Other income TR3 17 and 19.

Resolution

1. Select the client and the year of the loss.

2. Dividends and Capital Assets. You MUST have created or have a existing Capital loss first (such as a Capital asset/Share loss disposal or a Other Capital gain loss)

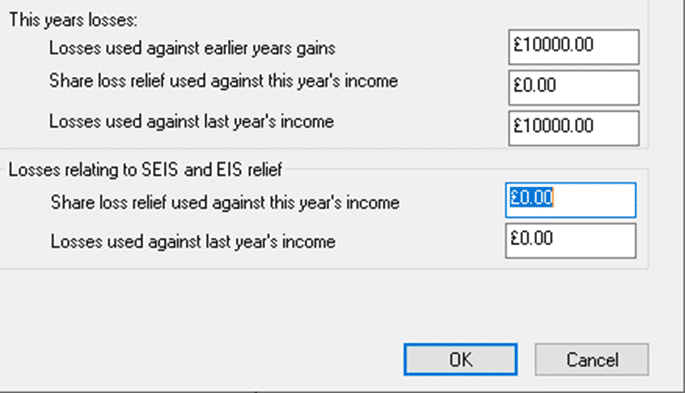

3. From the Capital Assets screen, Edit, select Losses and Other Information.

4. Complete the box:

- ‘Losses used against earlier years gains’ IF you want to claim more than 1 year back (eg 2+ years) – you need to add a note to explain which year you want to claim against.

- ‘Losses used against last years income’ section IF you want to claim for just last years then click OK.

5. Go to reliefs | Miscellaneous | Tax calculation | Tax code and Overpaid, Underpaid and Repaid Tax | Enter the change in tax/tax savings into ‘Tax underpaid (-ve) / overpaid (+ve) from earlier years’

6. Go to reliefs | Miscellaneous | Additional information | SA100 – You can then add a note advising on what you have done.

If you wish to send an amended return for the previous year where the loss to carried back to OR for your own internal bookkeeping, please do the following:

7. Select the year where you to carry the loss back to.

8. Other income | any other losses | “future trading or certain capital losses” | enter brought back figures

9. Reliefs | Miscellaneous | tax calculation | tax code / overpaid | fill in tax reclaiming now field – enter tax savings value

10. Go to reliefs | Miscellaneous | Additional information | SA100 – You can then add a note advising on what you have done.

NOTE: If you complete option 7 to 9 and not complete the steps 1 to 6. Then this loss entries will automatically be used against any ‘OTHER INCOME – any other income or profit’. This other income will not show on the tax comp (as the loss has deducted from it) and only appear on TR3 BOX 17 and 19.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.