Personal Tax- Making Tax Digital and MTD Status

Article ID

personal-tax-making-tax-digital-and-mtd-status

Article Name

Personal Tax- Making Tax Digital and MTD Status

Created Date

5th October 2021

Product

Problem

IRIS Personal Tax: Making Tax Digital and MTD Status

Resolution

April 2024 Update: Currently IRIS has made the decision to delay our participation in the current private pilot due to the instability of the technology HMRC are delivering and to ensure that we are able to deliver a robust and stable MTD solution. We will inform all customers when it is possible to take part in the MTD pilot, to register your interest please email MTD@IRIS.co.uk

In Personal tax (update Dec 2021 with the Version 21.4.0). At the top a option for Digital Tax displays.

MTD Data Mining

Although the mandating of MTD has been delayed to April 2024, this initiative will inevitably creep up and therefore preparation is the key to success.

Updates have been made to the existing digital tax client list (Digital Tax | Digital Tax Client List), to allow users to query client data; to identify which clients will fall within the MTD mandate first.

The new fields added allow you to identify clients with income above the £10k threshold across Trade, L&P and Foreign L&P (singularly or accumulatively).

2022 update with IRIS version 22.1.0

Making Tax Digital functionality has finally arrived, we have updated the personal tax product to enable you and your practice in preparation for the MTD pilot (April 2022).

MTD functionality will run alongside the standard SA functionality and will simultaneously complete the clients SA return as well as giving the ability to complete in-year obligations where a client has been identified as MTD compliant.

In this release of IRIS, we have focused on delivering functionality which will allow you to complete the in-year obligations associated with income sources which are required to be submitted quarterly, this will include sole trade and UK property Income.

All MTD related submission will be channeled through the IRIS Digital Tax Hub, where the software will guide you through the MTD workflow, highlighting any outstanding tasks to simplify a complex MTD workflow.

2022 update with IRIS version 22.2.0

In this release we are delivering functionality to allow individuals with foreign property income to be submitted to HMRC on a quarterly basis. We have incorporated this functionality seamlessly into the existing Digital Tax Hub.

Functionality covered for foreign property:

- submission of quarterly periods reporting income and expenses

- submission of adjustments and allowances

- retrieval of live financial position of foreign property business from HMRC

- retrieval and submission of Business source adjustment summary

- submission of End of Period Statement

Link to training video under the PT section: https://www.iris.co.uk/support/iris-accountancy-suite-support/iris-summer-2022-release-v22-2/

Autumn 2022 update with IRIS version 22.3.0

We have further improved the digital tax hub with the ability to update HMRC on the handling of additional income sources in anticipation of HMRC widening their MTD pilot criteria.

Using PT option at top – Digital Tax and ‘Digital tax client list‘

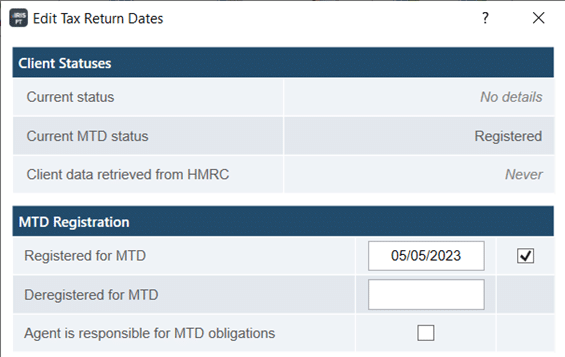

You will get a list of your PT clients with MTD status of NOT Registered or Registered. This status is linked to MTD registration within Administration | Edit tax return dates– Registered for MTD – tick and add in date, save and it changes to registered (if it still shows as not registered then edit the date to the past) . Note: This has NO affect for clients HMRC data retrieval process (where data only appear after Summer) and its only for your own internal record keeping for each client.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.