Personal Tax- Part and Full Distribution Disposal of Shares? Dividend Distribution

Article ID

personal-tax-part-and-full-distribution-disposal-of-shares-dividend-distribution

Article Name

Personal Tax- Part and Full Distribution Disposal of Shares? Dividend Distribution

Created Date

16th January 2024

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- Part and Full Distribution of Shares? Dividend Distribution

Resolution

IRIS Personal Tax has no tool/function/reports for the Part and Full Distribution disposal of Shares (For Example: Liquidation Payments received from Liquidators etc). Your client has 50 shares and need to to record the Part Distribution of shares in one year and a Full Distribution in a later year.

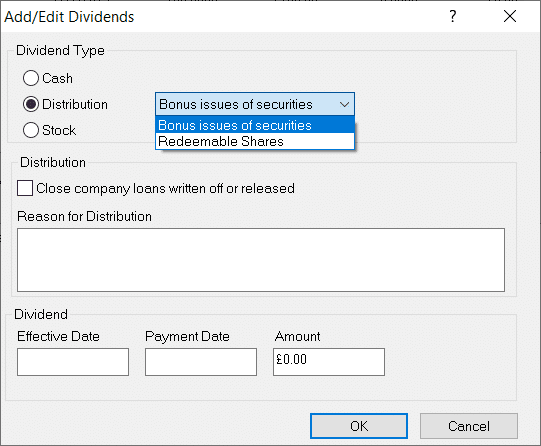

There is a Dividend Distribution option in PT (Capital Asses/ Shareholdings/ Dividends)

You have several options under Capital Assets/ Shareholdings- if you are unsure then contact a Tax Advisor Or HMRC Support on what they recommend.

- Create 50 shares and dispose only 25 in a year (add a note to state Part Distribution) and in later year for the rest of the 25 shares to dispose (add a note to state Full Distribution etc)

- Create 50 shares and dispose all in a year (add a note to state Part Distribution) and in a later year recreate the same 50 shares and dispose all that year (add a note to state Full Distribution etc to state these shares are the same as prior year)

- Create them under ‘Other Capital Gains’ as a gain(or loss) and add a note to state Part/Full Distribution for each year.

- To add a note: either go to Reliefs/Misc/ additional information – SA100. Or under Capital Assets, Edit, Losses and Other info and tick ‘Additional Information’.

If a ‘Dividend Distribution’ – create the share and go to Dividends, select the share and there is a option for Distribution and choose the relevant option and amount

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.