Personal Tax- Self employment OR Income Tax relief shows on SmartTax but not on Tax comp

Article ID

personal-tax-self-employment-shows-on-smarttax-but-not-on-tax-comp

Article Name

Personal Tax- Self employment OR Income Tax relief shows on SmartTax but not on Tax comp

Created Date

18th August 2022

Product

Problem

IRIS Personal Tax- Self employment OR Income Tax relief shows on SmartTax but not on Tax comp

Resolution

When you check Smarttax – you note a value in Smarttax but it is not showing in the Tax computation.

If a Self employment: Make sure there is no cessation date for the sole trade business or a TO date for the trader- remove these dates as they omit the value showing on the tax comp. This has been reported onto our Development team that Smarttax is still incorrectly pick up income data when the business has actually ceased.

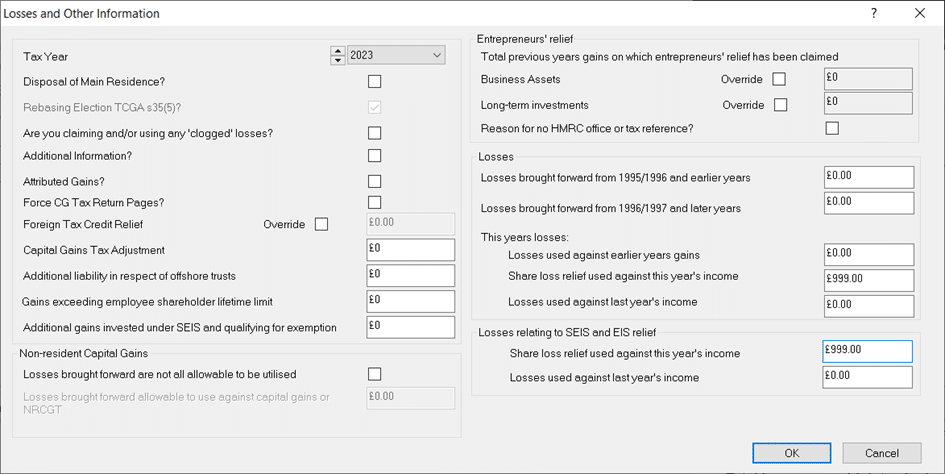

If a Income Tax relief: Go to Dividends, Capital Assets, Edit, Losses and Other info, check if you have a Share loss relief this year entry (eg £999 see image below) – this is triggering the relief to show on the Smarttax BUT there is NO SEISS/EIS loss entry anywhere under ‘shareholdings’ or ‘Other capital gains’ which is why its not showing on the tax comp (simply a loss entry is made here when there is no actual loss in shares or capitals). You have several options:

- Remove the Share loss entry under Losses and Other info and add it as an additional note to explain this loss is from.

- Create an actual Share/OCG loss entry with correct dates so it corresponds to the Share loss entry under Losses and Other info.

- NOTE: If you decide to keep this ‘Loss relief’ in under step 1) and also not do step 2)- the Smarttax and Tax comp will still show the same final tax calc (Smarttax will just show a extra line with the Loss relief). We would recommend you run step 1 or 2.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.