Personal Tax- Sole/partnership Trade loss not being used on another sole/Partnership trade gain

Article ID

personal-tax-sole-trade-loss-not-being-used-on-another-sole-trade-gain

Article Name

Personal Tax- Sole/partnership Trade loss not being used on another sole/Partnership trade gain

Created Date

8th December 2022

Product

Problem

IRIS Personal Tax- Sole/Partnership Trade loss not being used on another sole/partnership trade gain

Resolution

HMRC rule – You can only use the loss against the same trades future gains. You cant apply this rule with two or more separate sole trades or partnerships.

For example: If you have 2 separate sole trade businesses, you cannot use ones loss against another trades gain. These two trades counts as ‘two’ entities which means you cannot share the losses between them (as per the HMRC rule).

Note: There is no tool in PT to merge 2 sole traders (or Partnerships) together.

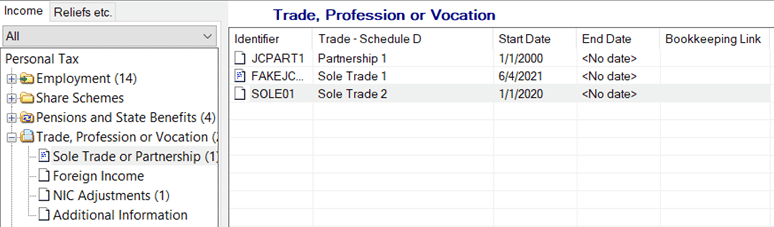

See image below – Sole trade 1 and Sole trade 2 count as separate businesses, you cannot use the loss from Sole Trade 1 against Sole Trade 2 profits.

Workaround if these two sole trade businesses are meant to one sole trade business

If you believe the two trades are the same entity (eg one sole trade) – then you need to decide which sole trade to keep (eg usually the one which has run the longest and has the loss) and remove the one which is brand new (put a ceased date in the past for it so I wont show up). Then Manually add in the income etc figures of the sole trader you ceased INTO the loss making sole trader loss you still have running – and fill this in again. This rule also applies to Partnerships.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.