Personal Tax- UK Property and Rent-a-room scheme relief

Article ID

personal-tax-uk-property-and-rent-a-room-scheme-relief

Article Name

Personal Tax- UK Property and Rent-a-room scheme relief

Created Date

24th April 2023

Product

Problem

IRIS Personal Tax- UK Property and Rent-a-room scheme relief

Resolution

- Log into Iris Personal Tax and select the client and year

- Click on UK Land and Property | Property Income

- Double click on the property

- Click on the magnifying glass next to Income type

- Select type G for Rent-a-room scheme (This will automatically apply the relief)

- Click on Ok

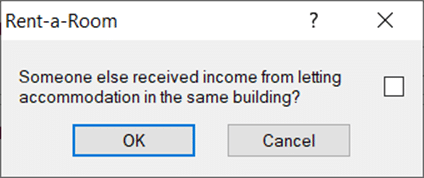

- IMPORTANT: Another box will pop up and you would only tick this box if the property is jointly held and the relief needs to be split between two people. If it does not need to be split then you do not need to tick the box and click on Ok

- IF the income is below the HMRC threshold for rent a room, then only box 4 UKP1 is ticked, If above the threshold then box 4 is not ticked and the the relevant UKP pages will be completed instead.

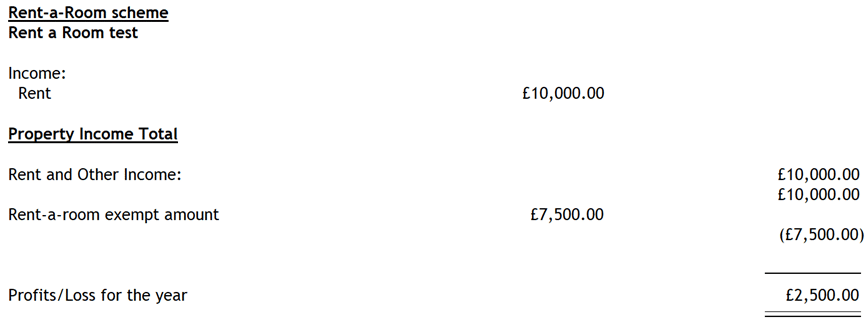

It may show on the Schedules of Data like this for 2024 and £10,000 rent with a exempt amount if its not split (if it is split – it will show as £3750 etc).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.