Personal Tax: Unlisted Share and Securities - There is a entry in (SA108 Losses claimed against income etc)

Article ID

personal-tax-unlisted-share-and-securities-there-is-a-entry-in-sa108-losses-claimed-against-income-etc

Article Name

Personal Tax: Unlisted Share and Securities - There is a entry in (SA108 Losses claimed against income etc)

Created Date

17th January 2022

Product

Problem

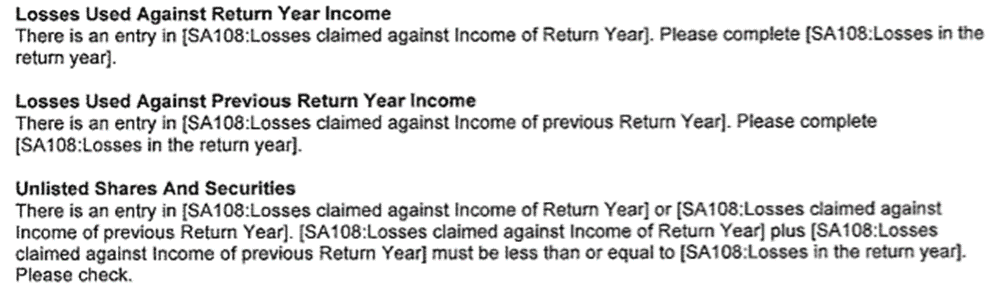

IRIS Personal Tax: Unlisted Share and Securities - There is a entry in (SA108 Losses claimed against income etc)

Resolution

Follow all the steps below:

1. Go to Edit / Capital Assets / Other Capital Gains and Shares (check both). Open the related share/OCG loss(es) and tick ‘Unlisted Shares’ in Asset Type | OK.

2. Regenerate and submit. If you get a same error again then check the total share loss claim and entries, go to step 3.

3. Check the unused losses for the year, so remove the any Relief claim entries under Edit | losses and other information and run the CG comp and it will show at the bottom of the computation what the unused relief is, and you can only claim up to this amount. Go back to the Losses screen and enter the relevant value within the amount.

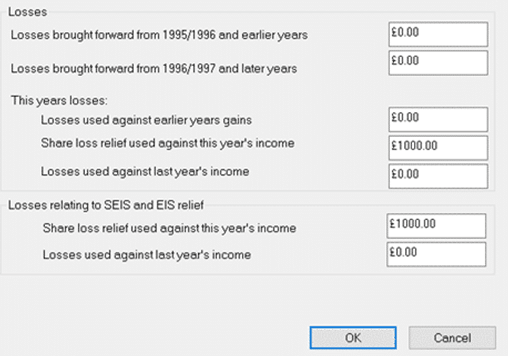

4. Go to Capitals assets/ Edit/ Losses and other info – look at the TWO loss claim entries on bottom right of losses to be used (Share loss relief used). Do they add up the total loss value of the unlisted shares? They have to add up correctly or you will get this error. For example if you have losses totaling £1000, it should be entered like this: (if one or both are higher value then it can cause the error)

4. Open the shareholding or OCG event which was ticked unlisted shares – if it was ticked as ‘Business Assets’ then untick it and save.

5. Check your loss is under these 2 areas: Shares or Other capital gains. If you have an Asset and disposed as a loss then this may trigger this warning (as there is no unlisted share option), so move this entry into Shares or Other capital gains.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.