Trust Tax- Dividend rate for 2022/23 at 8.75%- Tax comp/SA900

Article ID

trust-tax-dividend-rate-for-2022-23-incorrect-needs-to-be-8-75

Article Name

Trust Tax- Dividend rate for 2022/23 at 8.75%- Tax comp/SA900

Created Date

21st December 2022

Product

Problem

IRIS Trust Tax- Dividend rate for 2022/23 at 8.75% on Tax comp and SA900 and R185

Resolution

SA900: IRIS version 23.1.0 is now released with the new Dividend 8.75% on Trust tax which will show on the Tax comp and if Estate in Admin- Page 10 Q17 box 17.1 (which is the total tax calc not just Dividend)

DEFECT on the R185 form (For all Trust Types), should be calculated at 8.75% but still taxes at 7.5%. This is now fixed on IRIS update 23.2.0 released week commencing 17th July 2023. If you need to urgently send this then as a workaround you can print the form and complete it.

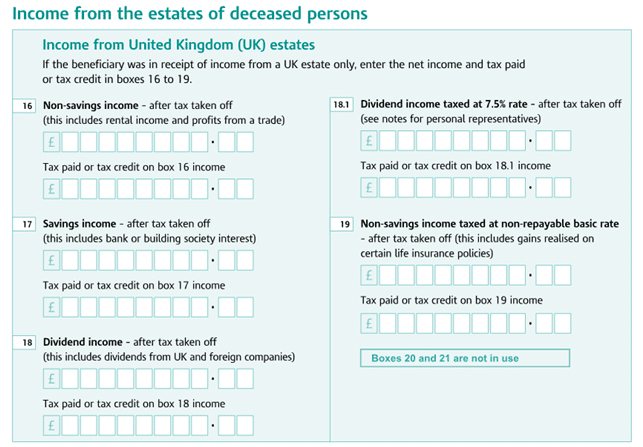

R185 display: For Example Estate in Admin type, there are different Dividend boxes, Box 18 is the Dividend rate and Box 18.1 has not changed and is still correct at 7.5% Dividend rate. A 3rd box 21 will only show up for certain Trust types. A Discretionary trust will show on Box 5 etc.

NOTE: Always run and check the Tax comp first. A Trust may have no dividend income because their Management expenses relief is reducing to 0 and so there is nothing to give to beneficiaries and thus it will not show any values on R185.

IF a Estate in Admin type: (A Discretionary type only allows you to enter one total payment)

1) Load client and year – Go to Data entry

2) Other information

3) Payments to beneficiaries (tax pool)

4) Print R185

5) If the beneficiaries have already been set up with their share percentage, highlight one and click Edit. Otherwise click New and set them up.

6) Then click on ‘Worksheet’ for this beneficiary

7) Scroll down to the tax year eg ‘2022-2023’ income and tick the box Override, and fill in PAID column on allocation

8) Along the top columns there are 3 Dividend sections. The 1st one is ‘Dividend’ and the 2nd is ‘Dividend non-repayable‘ and 3rd is ‘Dividend dist post 2022’ (this column only appears with the 23.1 update).

The first populates box 18. 2nd populates box 21 (Box 21 only appears for certain Trust types). 3rd is for Box 18.1 taxed at 7.5%. Your Dividend allocation info could be currently in the wrong Dividend column. Therefore, after once ticked override, remove the value from within the incorrect one and add it into the other one. As a test – just swop the values between the 3 sections to see the change on the R185.

9) You can keep everything else the same including the amount allocated in the year and click ok.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.