Trust Tax- Estate in Admin Residential relief in 3.46 box

Article ID

trust-tax-estate-in-admin-residential-relief-in-3-46-box

Article Name

Trust Tax- Estate in Admin Residential relief in 3.46 box

Created Date

8th December 2022

Product

Problem

IRIS Trust Tax- Estate in Admin Mortgage Residential relief in 3.46 box - why is it missing

Resolution

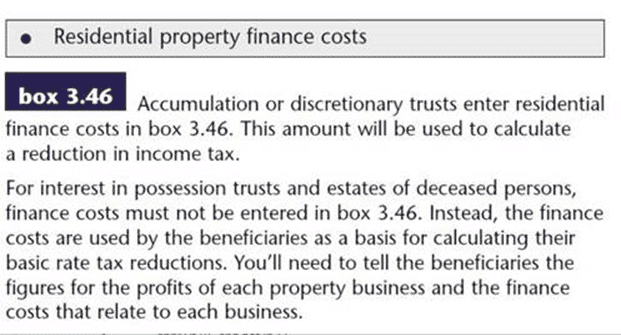

HMRC SA903 Notes, it states that ‘For Interest in Possession trusts and Estates of deceased persons, finance costs must not be entered in box 3.46.’

The HMRC notes also mention ‘AND individuals’ then this means the Mortgage relief may be claimed under Personal Tax(as for a individual) and not under Trust tax. Instead we include the figures on the R185 and the correct figures should to be transferred to the personal tax return of the beneficiary.

It is important to note that the rules differ depending on the type of trust. For Accumulation or Discretionary trusts we continue to use the excess finance costs as a basis for calculating the basic rate tax reduction, and continue to print the value in box 3.46 of the return.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.