VAT Filer- How to submit your own companies VAT return?

Article ID

vat-filer-how-to-submit-your-own-companies-vat-return

Article Name

VAT Filer- How to submit your own companies VAT return?

Created Date

9th May 2023

Product

Problem

IRIS VAT Filer- How to submit your own companies VAT return?

Resolution

There are two pathways for you to choose – please read both before proceeding:

1.If you ONLY submit your own VAT (You have no clients, you bought the VAT software just for your own company):

a) Load your own company in the VAT filer, Client and View, Accountant and check its set to AGENT. Exit and back to main VAT screen, now click ‘Client refresh’ – Log in using your original MTD credentials (this is a HMRC agent login AND NOT the other ‘Agent Services Account ASA’) for your business and you can now submit VAT for their own company. The login for ‘Agent Services Account ASA’ (setup from the HMRC site) is only used if you want to submit another companies VAT for them.

Warning: If you get errors like ‘VAT registration is not valid’ etc then recheck your companies VAT code (delete and type in again), if its set to the correct Agent or Alternative and you have logged in using your original MTD credentials (and not the ASA login). If all are correct but you still get the error then you need to contact HMRC Support.(As IRIS doesn’t create or support these HMRC agent credentials).

Warning: When checking the ‘Accountant’ section: if its already set to Alternative or Branch (and not agent), stop and first ask your team if there are ANY other VAT users with logins being used, if they state yes or its unclear then follow the below steps for If you submit for other companies and your own VAT (eg your an accountant for several clients) then go to Option 2) below to set up a new alternative logins.

If you get the error: ‘Failed to retrieve client obligations due to agent/client not being authorised’ when completing own VAT submission you have used the incorrect login OR you have set the accountant to wrong setting eg Agent or Alternative OR your VAT code is incorrect. If you have checked all three and they are correct then you will need to contact HMRC support to check your login and your VAT code.

If you have submit for your own company but you have multiple offices with their own ASA logins then go to Option 2) below instead and set up multiple different Alternative offices.

2. If you submit for other companies and also your own VAT (Your an accountant for several clients):

You will need need to setup two separate accounts: one for your company and for your clients, follow the steps below:

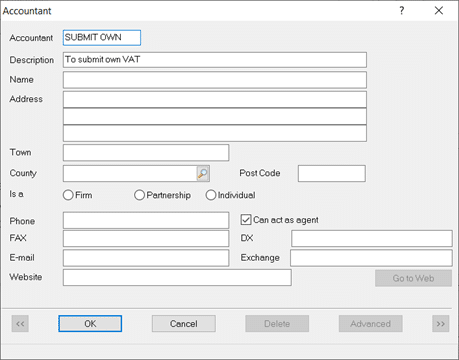

1) Load your own company in the VAT filer. Client view, Accountant- switch to ‘Alternative’ accountant – new and create that new account and ensure it includes the text ‘VAT’ – then make sure its ticked ‘Can act as agent’ (may need to be Master to do this)

a) Click the ‘Client refresh’ button

b) Log in using your original MTD credentials for your business (and not the ASA login)

c) Can now submit VAT for their own company

2) For your other clients – Client view, Accountant- switch to ‘Agent’ accountant and ensure you logged in using your HMRC ASA login. Remember the ‘Agent’ setting is normally only used when submitting for other company VATs – so be careful not to mix up the alternative and agent accountants or you wont be able to submit the VAT

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.