Accountants! Know your worth. Price for your value and advice

Updated 6th April 2023 | 6 min read Published 15th June 2022

Our research suggests that one in three accountants are finding that clients are expecting them to deliver advisory services, on top of day-to-day compliance work, without paying for it.

Pricing is an emotive subject in the accountancy world right now.

Many firms spent the last two years going above and beyond to support clients through the worst of the pandemic, often at no extra cost.

However, with GDP falling and markets beginning to slump, it’s critical to charge appropriately for the services your business delivers.

For accountants and bookkeepers, there are two aspects to consider.

Firstly, how do you get the most out of compliance work; ‘wringing the sponge’ as it were and not leaving money on the table.

Secondly, is it time to make a ‘mindset shift’ towards advisory? If so, how can these services be effectively communicated to customers.

1) It’s time for the unavoidable price increase

Let’s start with pricing compliance work. Some accountants I have spoken with recently have not increased their prices for 5-7 years. How can this be?

The cost of doing business today is so much higher than it was half a decade ago. General inflation is at an all-time high, labour costs are sky rocketing and supplier prices are all creeping up.

Even if you are not looking to actively recruit, it is costing more to retain the staff you have.

All businesses are having to provide more reasons for existing staff to stay; whether it’s pay increases, improved benefits packages or additional perks, such as allowing staff to draw down on their salary before payday.

It all comes at a price.

No doubt your software costs have also increased. With Microsoft upping their Azure cloud platform fees by 10%, cloud software pricing has increased in line with this.

Price increases are inevitable and it’s time to implement yours, against the cost of living/inflation at least.

Consider trialling new fee structures on a selection of low profitability, high demand clients. This is not something you need to be apologetic about.

If a client responds badly to this news, the silver lining is that you’ve increased your capacity and average profitability by losing them.

Additionally, you can review the feedback to modify your approach before implementing fee increases more widely.

2) Build a price book for advisory

Busy accountants rarely find the time to take a step back and reflect. Our recent Accountancy Report revealed that one in four accountants want to introduce more value-added services but are time-poor supporting existing clients’ needs.

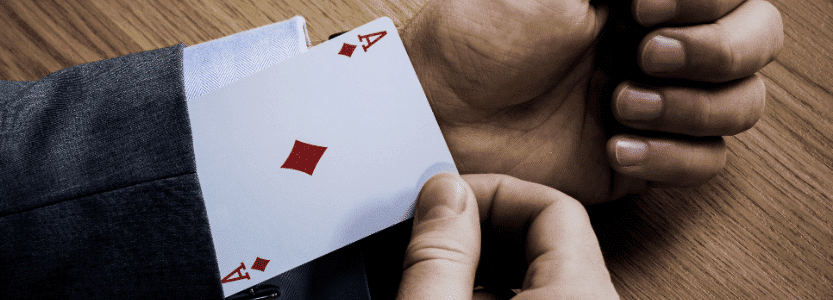

Selling ‘time’ in exchange for money is the calling card of an accountancy practice.

Firms often base their pricing on the time spent, services delivered or by relying on pricing software to dictate fees. Very few accountants charge clients by the value they actually deliver.

Accountants often spend hours working on tasks that deliver low client value, while a twenty-minute phone call to a client could transform the entire relationship.

Value, not time-based fee structures, are the future for most accountancy businesses. This requires an updated skillset and the creation of a pricing pack or menu of services that staff can refer back to in client conversations.

Yes, staff need to be comfortable calling clients and asking ‘how’s business? Is there anything you’re struggling with?’

If a client responds and says they want help with wealth management for example, staff can refer to a service offering and suitable pricing for supporting this.

Not sure what service offerings have the lowest risk? Test a few ideas out with a couple of friendly clients and see what the response is. Find out what advice means to them and what’s bubbling up in their mind that they might need help with as a starting point.

3) The holy trinity of pricing

When it comes to pricing your advice, some of the UK’s top firms operate a pricing strategy that recognises the cost price, the ideal price and the walk-away price of their services.

The cost price: what it will cost your firm to deliver the service – from the time required to technology subscriptions – it’s your break-even price.

The ideal price: what you want to charge your clients based on what you feel the service is worth and the level of profitability you’d like in return.

The walk-away price: this should sit just below your ideal price, being the minimum fee you’re willing to deliver the service for.

These firms aim to not come down from their ideal price unless a value exchange is on the table, usually in the form of defined referrals.

Hopefully this has proved useful food for thought. Is your accountancy business ready to build on this opportunity?