What Making Tax Digital (MTD) means for you

Updated 29th December 2023 | 5 min read Published 6th December 2022

If you spend more than a minute or two with a couple of accountants, you will probably hear the words “Making Tax Digital” come into the conversation.

Making Tax Digital (or MTD) is a major development long in the planning. It was first conceived in 2015, and rollout began in 2019. By 2030, HMRC intends for everything from VAT to Income Tax, partnerships, and Corporation Tax to be moved to MTD, meaning it’s important most business leaders have a good understanding of the subject. For everyone already aboard, it’s worth a refresher: each future stage could further affect your business.

How did Making Tax Digital come about?

If you’ve ever submitted a tax return, you’ll know it can cause severe headaches. Many smaller business owners, for instance, must constantly focus on developing their companies – so it can be jarring to suddenly have to dust off paperwork and double-check old deals at year-end.

Because of the previous system’s deadlines, business leaders were often left racking their brains over transactions that happened up to nearly two years ago.

This, of course, leads to mistakes.

The UK Government says avoidable errors cost the Exchequer about £8.5 billion in lost money over the course of just one year.

Why Making Tax Digital is the answer

If the government is losing that much money, and business owners are under so much pressure every year, it’s time to rethink things.

MTD means many businesses will have to keep a digital record and submit online using industry-compliant software.

Under this new initiative, all sole traders and landlords earning £10,000 a year or more will have to provide quarterly updates to HMRC, use compliant software and regularly update their records.

An overview of Making Tax Digital’s rollout

We’re currently well into a process of change that affects different types of taxes.

VAT

MTD for VAT-registered businesses is already in place. Any company earning more than £85,000 has followed MTD rules for reporting VAT since April 2019, with other complex organisations like local authorities moving across from October that year. Those businesses below this threshold that still provide VAT returns moved to MTD from April 2022.

Looking for software to help you with taxes?

We can helpIncome

HMRC determined the next step in the rollout would concentrate on organisations going digital for income tax and National Insurance, starting in April 2024. For many traders, this new system replaces the self-assessment tax return process. It’s worth bearing in mind MTD for income tax has a specific scope: so far, self-employed businesses and landlords with annual income above £10,000 have been asked to register for Making Tax Digital... those below this threshold can carry on with their existing processes.

Partnerships

Making Tax Digital for general partnerships (i.e. not limited liability partnerships) has been delayed until April 2025, and there are no pilot plans. Meanwhile, MTD for all other partnership types has been delayed until after April 2025.

Corporation Tax

The UK Government will allow companies to partake in a pilot that will test MTD for Corporation Tax. The changeover will happen for everyone after April 2026 but before 2030.

What happens if you don’t comply with MTD?

If you fall under the criteria for MTD, then you need to follow the rules. There's a strict set of penalties for overdue submissions based on a points system, eventually triggering a £200 hit. Like before, late payments will often incur a percentage being added to the total amount that’s due to HMRC based on how far behind you’ve fallen.

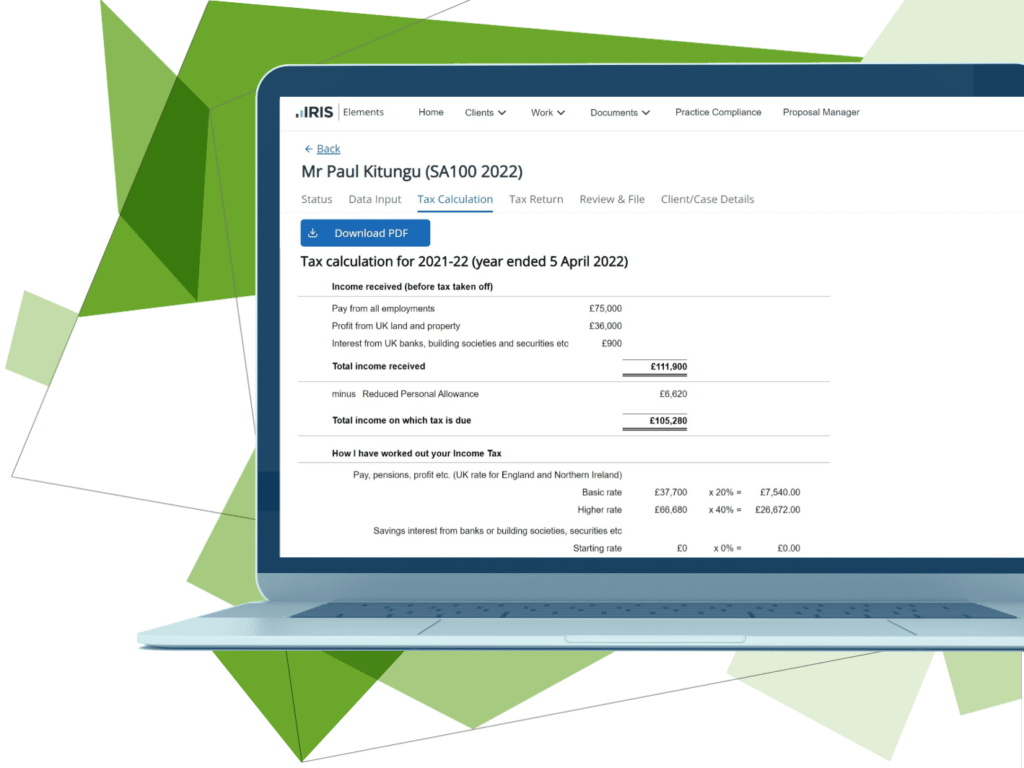

With IRIS, Making Tax Digital means Making Life Easier

All this means compliant, MTD-compatible software is important for accountants and individuals. Changing to IRIS software will mean a transition to something that feels seamless and easy to use… a significant step up from keying information into a web portal or setting things out on paper.

We provide a range of making tax digital software: from simple MTD applications to receipt capture solutions, bridging software that lets you use existing programs, and specialised cloud-based bookkeeping software.

Learn more about MTD – including our strategies, software, and advice on preparing for any upcoming changes:

Get the latest on MTD