$2.8 Trillion Lease Commitments Will Be Added To Balance Sheets Worldwide

Updated 12th May 2021 | 4 min read Published 29th January 2016

Earlier this month, the International Accounting Standards Board (IASB) published the long awaited changes to global lease accounting, IFRS 16. Along with the soon to be published FASB ASC 842 – the new lease accounting standard for US GAAP users – an estimated US$2.8 trillion worth of lease commitments that are currently ‘off-balance sheet’ will be added to balance sheets globally.

Under current IAS 17 and FASB ASC 840 (formerly known as FAS 13), operating leases were able to be treated as ‘off-balance sheet’ and were instead disclosed in the footnotes of an entity’s financial statements. According to the IASB, this meant that 85% of the $3.3 trillion lease commitments globally were not reflected within company balance sheets, leading to a repertoire of problems for investors and auditors.

"We really feel there is a need for a new standard because the old standard does not truly reflect economic reality. Companies have a lot of leases outstanding, more than 3 trillion dollars, and only a limited number of these show up on the balance sheet."

Hans Hoogervorst, IASB Chairman

The new standards require all leases to be capitalised, recognising all assets and liabilities arising from leases on balance sheet. This means that as of the 1st January 2019 for IFRS users and 15th December 2018 for US GAAP users, operating leases as we know them will effectively no longer exist.

"The off-balance sheet leases for a specific company can range from a few million dollars, on the low end, to tens of billions of dollars, on the high end."

Michael Cohn, Accounting Today

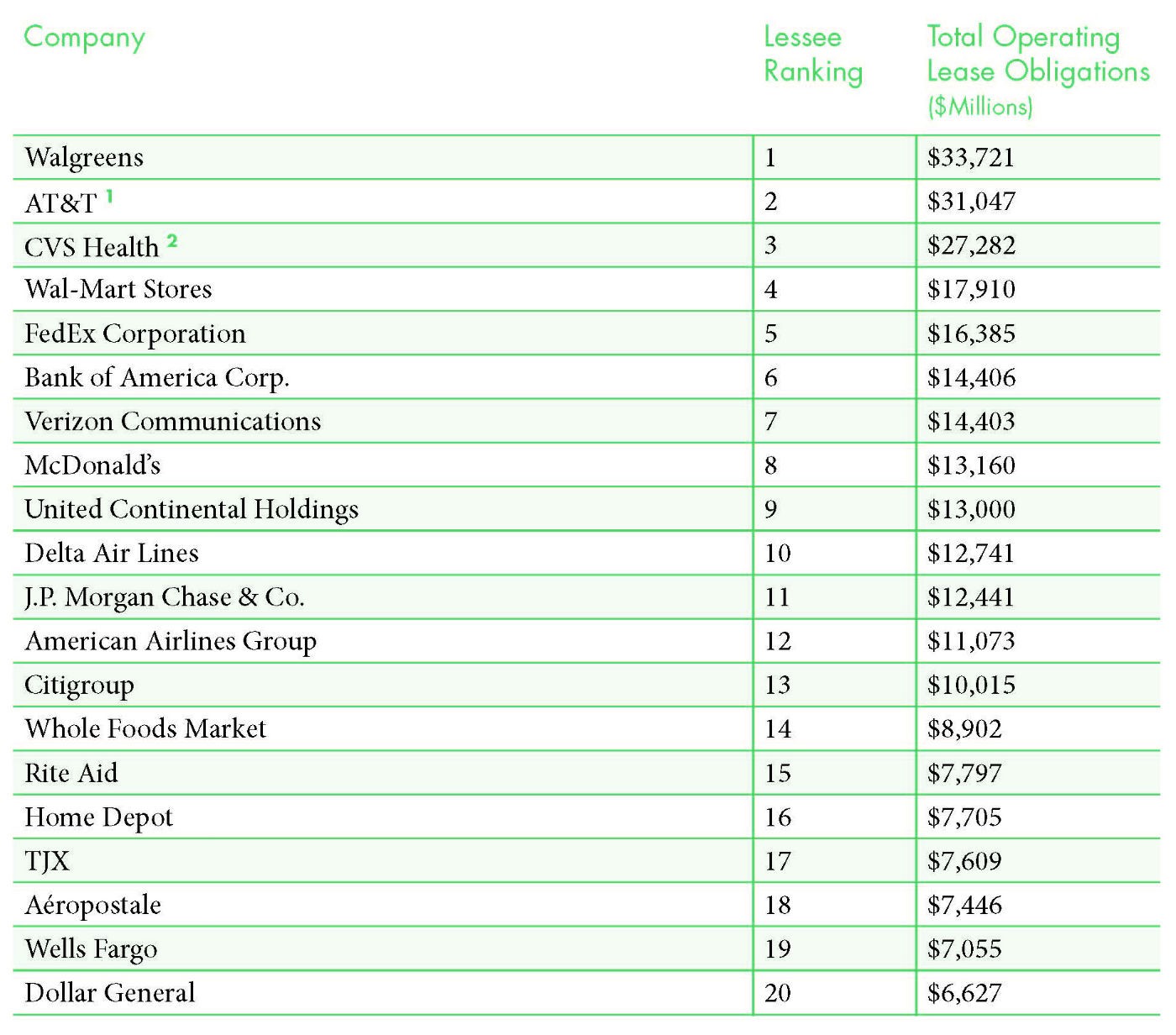

The IASB predict that 1 in 2 listed companies will be affected by the changes to lease accounting. Those that will see the biggest change are companies that utilise predominantly operating leases and recent research by LeaseAccelerator reviewed the off-balance sheet obligations of 500 of the largest public companies in the U.S. helps create a better idea of the potential impact the new accounting standard will have on companies.

The report “Who will be most impacted by the New Lease Accounting Standards?” many only focus on US based entities, but contributes to the concerns many accounting experts have highlighted about the realities of the practical implications the standards will bring.

"Some of America’s best-known companies – names such as AT&T Inc., CVS Health Corp. and Delta Air Lines Inc. – likely will soon have to effectively boost the debt they report on their balance sheets by tens of billions of dollars."

Michael Rapport, The Wall Street Journal

With some comparative reports required as early as 2017 and the data gathering and review process taking up to a year for larger businesses, finance leaders will need to strongly consider beginning their preparations for the new lease accounting standards as soon as possible.

As the biggest change to lease accounting in 30 years, the scope of the transition project should not be underestimated. As several of the leading accountancy firms have already shared their advice that businesses review the implications on their financial statements, companies may wish to look towards consulting leasing experts to ensure they are adequately prepared and on track to achieve full compliance by the time the first comparative reports are required.

"The publication of this standard is one of the most significant developments to date in the world of international financial reporting."

Nigel Sleigh-Johnson, Head of Financial Reporting Faculty at ICAEW

There is much work for companies to do to understand and implement the changes, not least in the area of data collection, and this work should be started sooner rather than later.

In order to calculate the extent their lease accounting will be affected by the upcoming standards, many businesses are utilising the automated reporting advantages of lease accounting software. These advancements in leasing technology enables them to centralise and store their leases and obligations as well as run reports to determine the impact the standard will have, identify the amount of operating leases that are currently active and even produce the required comparative reports to ensure they are compliant with the new standards in time for the implementation date.

Regardless of the method they choose, proactive and forward thinking business leaders need to begin taking actions to ensure they have full control of this transition to new global lease accounting and perhaps even turn these obligations into an opportunity for profit.

Share this article: