Personal Tax- Non-Resident with Excluded income (Disregarded), Double Taxation and Personal Allowance

Article ID

ias-10608

Article Name

Personal Tax- Non-Resident with Excluded income (Disregarded), Double Taxation and Personal Allowance

Created Date

3rd September 2012

Product

IRIS Personal Tax

Problem

IRIS Personal Tax rules with excluded income (Disregarded), double taxation and personal allowance?

Resolution

If the client is a Non-Resident under the Resident Questionnaire, IRIS performs two calculations in the background; one using personal allowances and other using excluded income. IRIS will use the one that is most beneficial.

‘Excluded income‘, also known as disregarded income, may appear on the tax calculation summary for a non resident client and relates to ITA07/S811. You cannot claim BOTH excluded income and personal allowance on the tax computation. It is the most beneficial which will be used and you cannot override this.

If you get a line on the Tax comp ‘Tax Otherwise chargeable on non-excluded income’ then read this KB link

What counts as Excluded income? Please see the HMRC help sheet: HS300 for more information and a full list of excludable income. https://www.hmrc.gov.uk/helpsheets/hs300.pdf

https://www.gov.uk/hmrc-internal-manuals/savings-and-investment-manual/saim1170

Is there a Excluded Income report? PT automatically calculates the excluded income and the tax on excluded income- as soon as you tick the ‘Non Resident’ on the Resident Questionnaire it will always show a breakdown of the calculation in the Tax computation. KB article: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-tax-otherwise-chargeable-on-non-excluded-income/

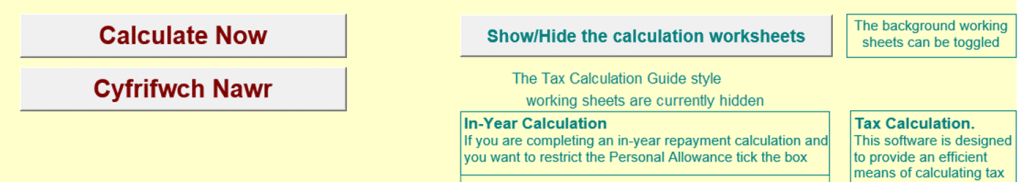

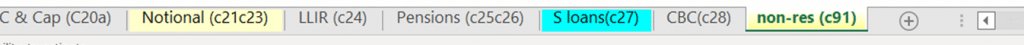

Need a FULL breakdown: If you run the HMRC TEST CASE generator (designed and available from HMRC) it provides a full breakdown. When you enter all the data into it, on the ADD PAGES tab, Click ‘Show/Hide the calculation worksheets’, on the far right tab click on ‘non-res (C91)’ it breaks down the calculation at the very bottom 2 boxes C91.27 and C91.35(or 28). If box below C91.35(or 28) shows a ‘REF’ it means no excluded income is given. On the ADD PAGES tab -click the ‘Calculate Now’ button and it brings up the tax comp with the breakdown of whether excluded income is given or not (read the explanation below).

Why client in 20/21 shows excluded income and in 21/22 it no longer has excluded income. The client has not met the HMRC rules to claim the excluded income for 21/22. If you run the HMRC TEST CASE generator (available from HMRC), it provides a breakdown on why its given or not. On the ADD PAGES tab – click the ‘Calculate Now’ button and it brings up the tax comp with the breakdown of whether excluded income is given or not (based on the comparison on Tax due and always using the lower value).

a. If its not given (Excluded income is the higher tax due), then on IRIS PT it will not be used on the tax comp.

b. If its given (Excluded income is the lower tax due) then it will be used on the tax comp.

I have Excluded income showing but the personal allowance wont appear either: Go to Reliefs, Misc, Tax Calc, Allocation of allowances and check if the ‘override’ is ticked – untick it and now the allowance appears on the Tax comp BUT it will still check which is more beneficial: excluded or allowance, you cannot claim both if Non Residential is ticked.

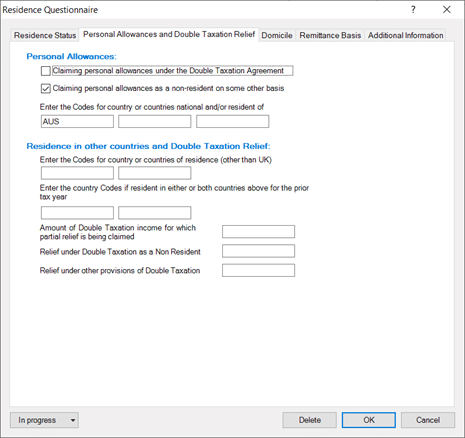

I do not have excluded income and need to claim personal allowance for a Non Resident: Reliefs, Misc, Residence Questionnaire, Personal Allowance and double taxation tab – tick Claiming PA as non resident. (or Double Taxation)

Also make sure ‘Non resident’ is ticked under Residential Status tab.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.