Business Tax- How to Enter 51% companies for CT600, Box 625?

Article ID

ias-12591

Article Name

Business Tax- How to Enter 51% companies for CT600, Box 625?

Created Date

6th October 2017

Product

IRIS Business Tax

Problem

IRIS Business Tax- How to Enter 51% companies for CT600 for box 625?

Resolution

There are different steps based on dates due to HMRC updating the rules: Pre 2023 and Post 2023

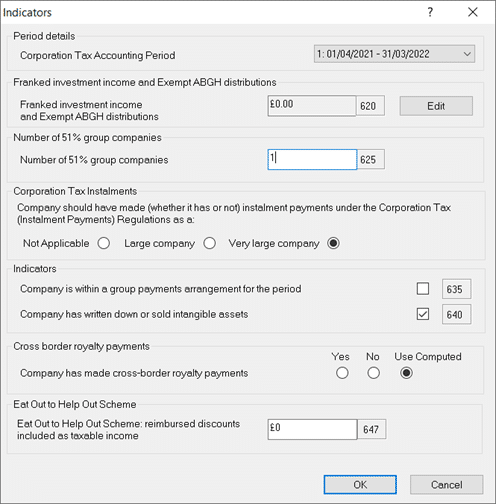

Pre 2023 51% rules: For 51% and to make an entry in the box: Load client in Business Tax and select correct period • Go to Data Entry at the top of the screen • Calculation | Indicators • You will need to make the entry in the field ‘Number of 51% group companies’ HMRC have changed the wording for this box.

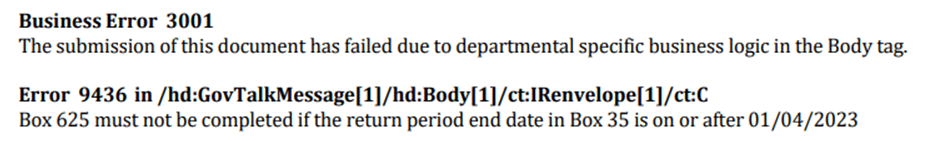

Post 2023 Old 51% box- What happens to this?: This no longer affects the tax calc from 2023 onwards (also wont show values on Tax comp, this is replaced with the ‘Associated Companies’ link here) and users get a warning 3001 9436 on this if they keep values in there (If you keep getting the error even when there is a 0 value in 625 then update to IRIS version 23.3.0). This 51% box will be kept in BT for your old records. If you do want to force it to show: Edit/Notes and declare it here.

51% appears on the BASIC Tax comp as two rows however it only needs to appear as one row: Our Development team are looking into this and as a workaround save the BASIC tax comp into word and remove the extra line if needed to be shown to client etc. The Enhanced comp will show it correctly as one row and this is the comp that goes to HMRC.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.