IRIS AP, PT, BT, Trust tax: Need report on active clients

Article ID

iris-pt-bt-trust-tax-need-report-on-all-active-clients

Article Name

IRIS AP, PT, BT, Trust tax: Need report on active clients

Created Date

13th August 2021

Product

IRIS Business Tax, IRIS Personal Tax, IRIS Accounts Production, IRIS Trust Tax

Problem

IRIS Accounts Production, Personal Tax, Business Tax and Trust tax - How do i create a report on all active clients.

Resolution

If using Accounts Production – Go to Help and About, the ‘Accounts Productions’ Tab- it will list the number of clients using charts.

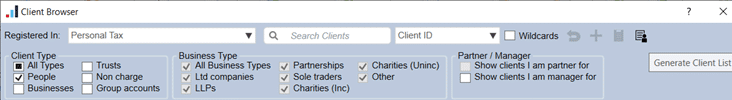

1.Load any client on a IRIS TAX/AP product (This report will not appear if you are on the IRIS main menu).

2. Client, Select.

3. On the ‘Client Browser’ screen, click the clipboard symbol (Generate Client List report) which is the last icon on the very TOP RIGHT.

If you do not see a clipboard symbol then go to the bottom/right side and click the PRINT button which allows you to create a report.

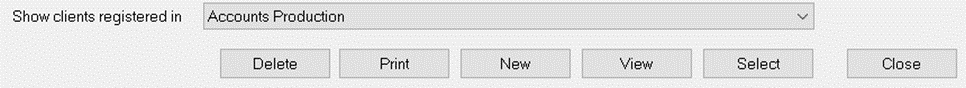

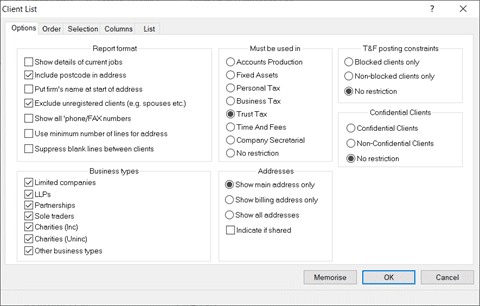

4. Choose the type of client in the ‘options’ tab under ‘Must be used in’ and also in the Selection tab as well (NOTE: If you need a report just for Trust Tax clients, you must also tick ‘Trusts‘ under the ‘Selection’ tab)

You can choose the other options like Order/Selection/Columns/Lists to edit the presentation.

5. Click OK and the Report Output options will display. You can tick Word / Excel /PDF if you need this report to be saved in those formats (remember to select where it should be saved to on your pc).

6. The report on active clients will be displayed. Scroll to the very last page to see a total of all active clients.

The reports will will not show any clients who are unregistered/archived explained on this KB article .

Accounts Production & Business tax Clients– Unregistering a client in AP/CS will NOT automatically unregister the same client in BT (and vice versa)- if clients need to unregistered for both BT and AP then it has to be done twice. If you run an active client report you may note a difference of client numbers then it is because of this, ID and just archive the relevant clients. If you try and load a client in BT and get a Unsuitable client warning

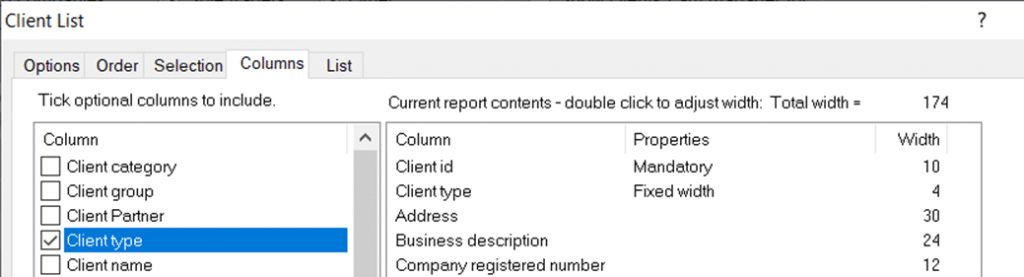

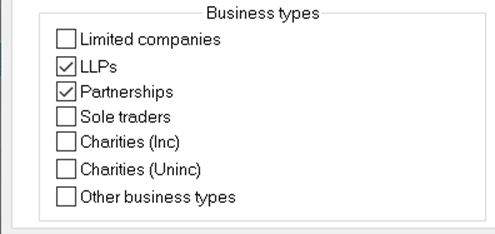

Need report on ‘Business Type’ from BT/AP clients. Go to the ‘Columns’ Tab (see image below) tick ‘Client type’: this adds a ‘TYPE’ column on the report and shows their business type. BL- LTD, LL- LL, BS- Sole trade, BP – Partnership etc. OR on the ‘Options’ Tab, on the bottom left, only tick the business types you want to shown on the list (eg LLP and Partnerships)

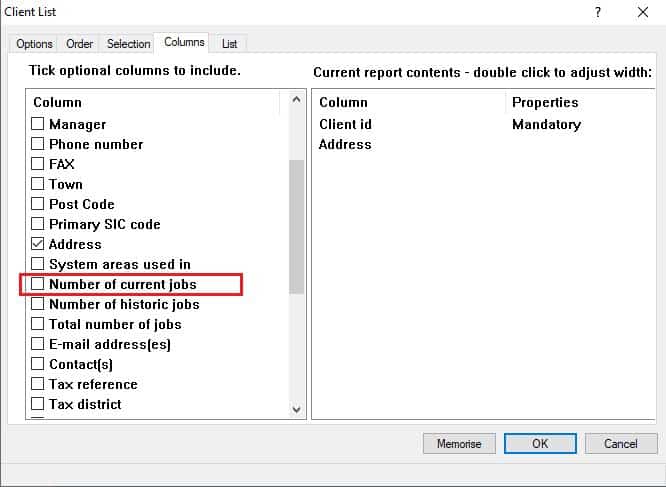

What the column ‘CURR’ means? This column relates to having the “Number of current jobs”. It will display the number of current jobs relating to each client. Jobs are a part of Practice Management, if you don’t use this, then you can remove that column from that report by going to the ‘Columns’ tab and unticking ‘Number of current jobs’.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.