Personal/Business Tax: You must setup your User ID and password before generating/submit

Article ID

personal-and-business-tax-you-must-setup-your-user-id-and-password-before-generating-an-internet

Article Name

Personal/Business Tax: You must setup your User ID and password before generating/submit

Created Date

1st October 2021

Product

Problem

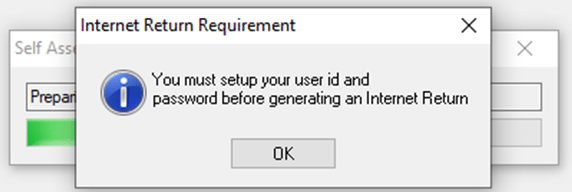

IRIS Personal/Business Tax: You must setup your User ID and password before generating an Internet when you try and generate/submit a Internet return

Resolution

- Go to Help and About and ensure you are on the Latest IRIS version.

- Log in to IRIS as a MASTER user

- Load client in PT or BT

- Setup

- Practice options

- Tax options

- Make sure the Self assessment Tab Or Corp Tax is filled in correctly (type in the details and DO NOT COPY and paste data into the fields).

- If you still get the warning then go to Client, View and Accountant

- If its set to ‘Alternative or Branch’ then you need to check if it should be switched to ‘Agent’ instead and save and generate the Return again.

- If you do want to leave on ‘Alternative/Branch’ then read the steps below:

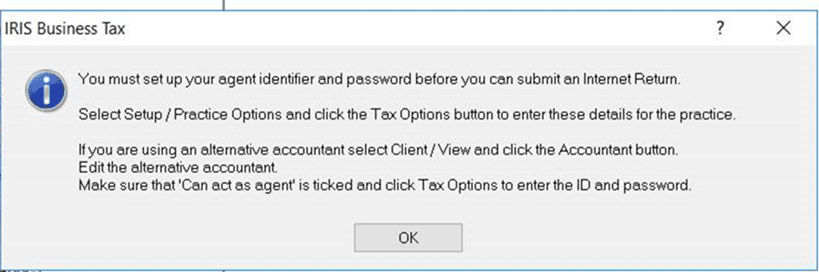

How to set up ‘Alternative’ accountant (see step 8): Alternative accountants are usually set up if a practice has several branches/offices which have their own Agent Credentials login details (i.e. You don’t use one login for all the branches).

- Client, View , Accountant, Set to ‘Alternative’ and click the magnifying glass. Either create a new one or select an existing one. You must tick ‘Can act as agent’ and click OK to save it and click view on it again. More options will show (You may need to log in as MASTER): Click ‘Tax options‘ Open the ‘Self Ass.’ or ‘Corp tax’ tabs – and complete the fields with the branches correct agent credential ID and Password.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.